The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

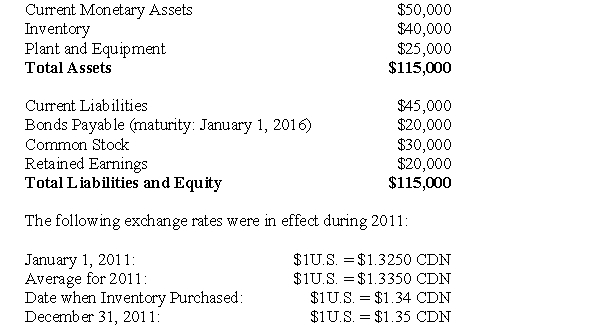

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

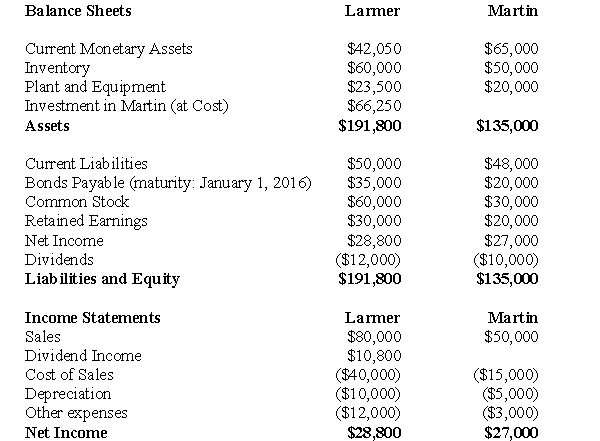

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Calculate Larmer's Consolidated Net Income for 2011.

Definitions:

Exhaustion Stage

The final stage of the General Adaptation Syndrome where the body's ability to resist stress and adapt is depleted, leading to increased susceptibility to illness and disease.

General Adaptation Syndrome

A triphasic sequence (alarm, resistance, exhaustion) that outlines the bodily responses experienced during stress.

General Adaptation Syndrome

A three-stage response (alarm, resistance, exhaustion) that the body goes through under prolonged stress.

General Adaptation Syndrome

A model describing the body's stress response in three stages: alarm, resistance, and exhaustion.

Q5: Assuming once again that LEO uses the

Q12: Prepare Plax's Consolidated Income Statement for the

Q34: The cumulative average-time learning curve can be

Q36: Assume that the facts provided above with

Q45: Prepare the December 31,2013 Balance Sheet Presentation

Q53: Selectron Inc acquired 60% of Insor Inc.on

Q57: The Pooling of Interests Method is no

Q86: The textbook defined open-ended problems as problems

Q162: Which cost estimation technique is useful in

Q169: Music Masters produces and sells two CDs,