The following information pertains to questions

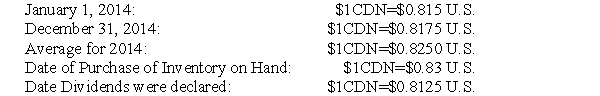

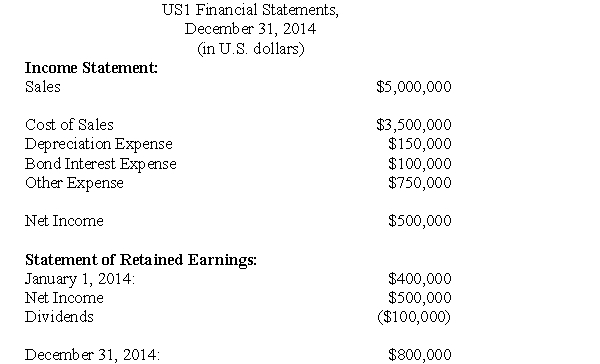

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

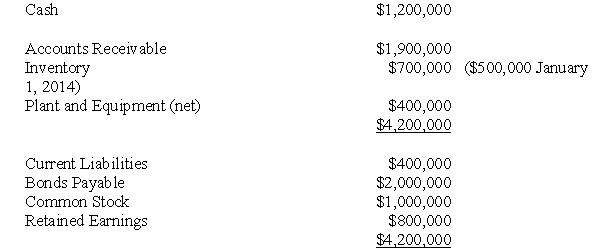

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's Retained Earnings at the start of the year?

Definitions:

Co-payment

A co-payment is a fixed amount paid by a patient for receiving a particular medical service, with the remaining balance covered by insurance.

Professional Services

Services provided by individuals or companies that require a high level of training or education, typically in specialized fields.

Specified Amount

A particular or set quantity determined or designated in a given context.

Medicare-approved Amount

The maximum amount that Medicare will pay for a covered service or item, which providers agree to accept as full payment.

Q11: Textbook costs are an opportunity cost of

Q12: On the date of acquisition,the parent's investment

Q29: ABC Inc.has acquired all of the voting

Q32: The rate charged by commercial banks for

Q36: Assuming that Parent Inc.purchased 80% of Sub's

Q49: Heesacker Co. sells a product with a

Q52: Compute the goodwill on the acquisition date.

Q65: In a regression equation, fixed costs are

Q155: Regression analysis is classified as simple or

Q168: Anya is the marketing manager at Education