The following information pertains to questions

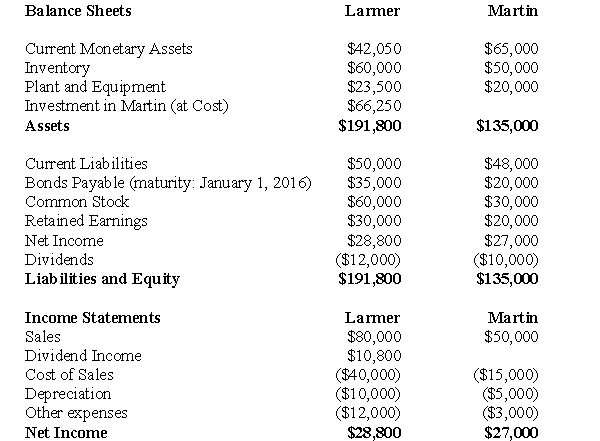

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

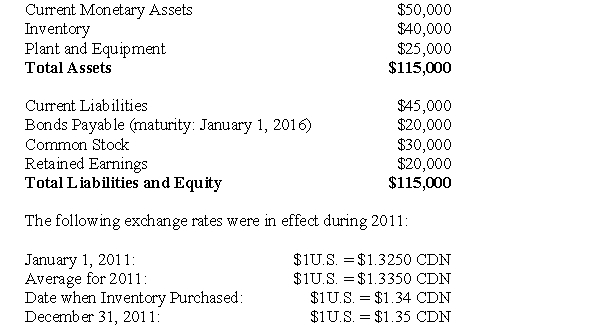

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Translate Martin's 2011 Income Statement into Canadian dollars.

Definitions:

Long Run

A period in which all factors of production and costs are variable, and companies can adjust all inputs to the production process.

Market Price

The actual selling price of a good or service in the marketplace, determined by supply and demand.

Price Takers

Market participants who accept prevailing prices because they have no power to influence the market price due to their small market share.

Perfect Competition

A market structure characterized by a large number of small firms, homogeneous products, free entry and exit, and perfect information, leading to firms being price takers.

Q22: Under which of the following Theories is

Q24: Consider the following cost data for the

Q26: Three different divisions of a toy manufacturing

Q29: Assuming that Hanson had no recorded goodwill

Q30: The amount of deferred taxes appearing on

Q39: Section 1625 of the CICA Handbook states

Q40: What would be the journal entry to

Q56: Prepare a statement of non-controlling interest as

Q60: What is the required adjustment to ABC's

Q61: A vision statement helps employees understand how