The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

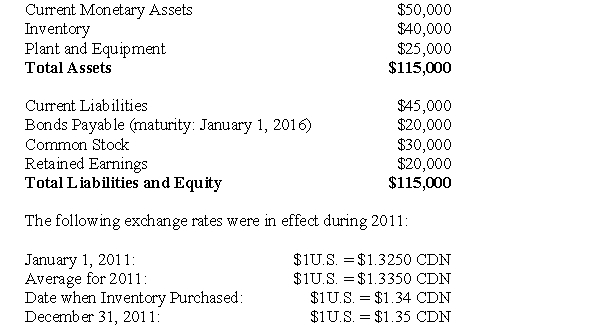

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

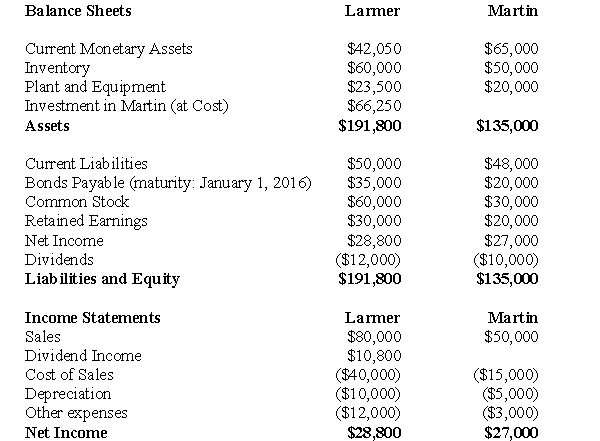

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Translate Martin's December 31,2011 Balance Sheet into Canadian dollars.

Definitions:

Frontal Lobe

The part of the brain located at the front of each cerebral hemisphere, associated with complex cognitive functions including behavior, learning, personality, and voluntary movement.

Propositional Representation

A method of representing information by expressing it as propositions or statements that relate concepts.

Visual

Related to seeing or sight, involving the use of vision.

Pictorial

Pertaining to or expressed in pictures; visual.

Q8: Which of the following statements best describes

Q9: An organization's accountant is estimating next period's

Q25: One type of uncertainty managers face in

Q27: Prepare a detailed calculation of Consolidated Net

Q29: Which of the following statements is correct?<br>A)Under

Q31: Prepare Alcor's Consolidated Balance Sheet as at

Q61: Ignoring income taxes,what is the amount of

Q105: Liva Company wants to develop a cost

Q140: SDZ Corporation produces and sells a single

Q154: If the sales mix changes:<br>A)The fixed costs