inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

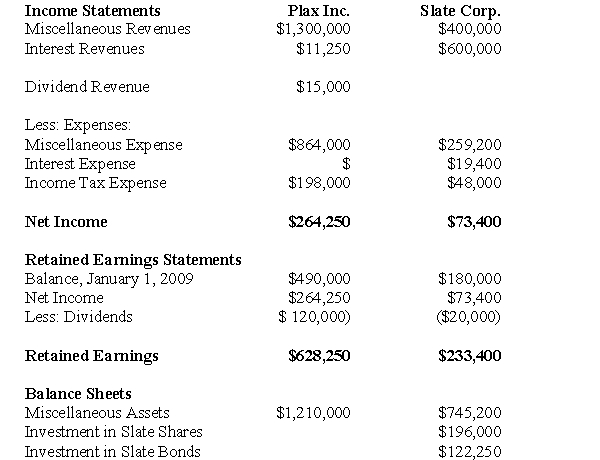

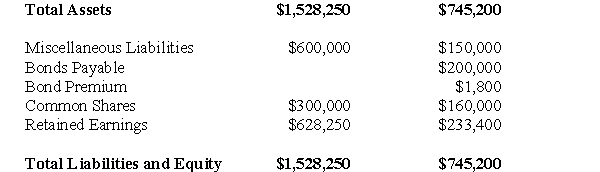

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a detailed calculation of Consolidated Net Income.Do not prepare an income statement for this requirement.

Definitions:

Functionalism

A theoretical framework in sociology and anthropology that explains social institutions and structures by the role they play in society.

Adapt to Environment

The process by which organisms adjust and change in response to their external environment.

Psychology

The scientific study of the mind and behavior, encompassing various aspects of conscious and unconscious experience.

Functionalism

A theory in the social sciences that explains social structures and institutions as collective means to fulfill individual and societal needs.

Q7: Assuming the subsidiary showed a profit for

Q25: Which of the following must be possible

Q30: Assuming that X Inc.used the equity method,what

Q33: When the parent forms a new subsidiary,<br>A)there

Q34: What would be the balance in the

Q42: Dragon Corporation acquired a 7% interest in

Q43: Which of the following journal entries would

Q45: What would be the journal entry to

Q51: Which of the following would NOT be

Q57: When are profits from intercompany land sales