The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

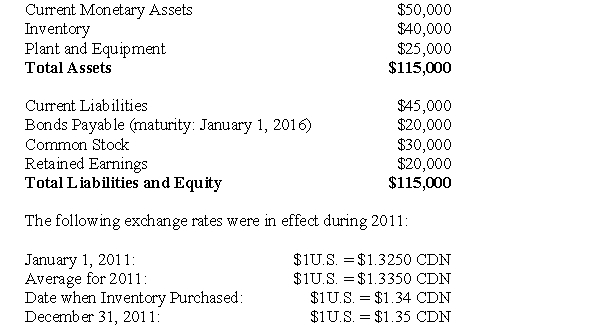

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

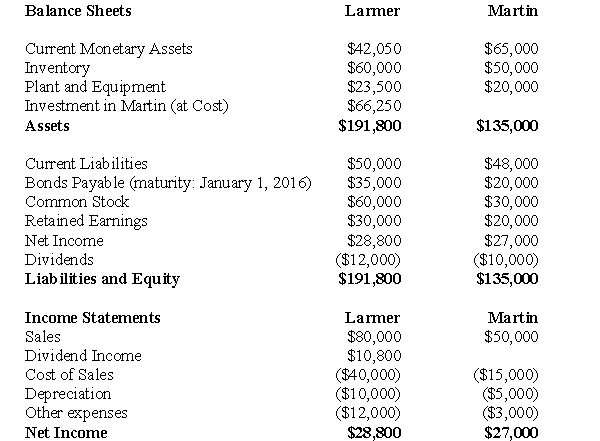

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Prepare Larmer's December 31,2011 Consolidated Balance Sheet.

Definitions:

Braking Speed

The rate at which a vehicle can decelerate and come to a complete stop, usually measured in meters per second squared (m/s²).

Internal Validity

Relates to the extent to which a study can establish a cause-and-effect relationship between its variables, free from external influence.

External Validity

How broadly a study's conclusions can be extended to various scenarios and populations.

Artificial Atmosphere

A man-made environment that replicates the conditions of a natural atmosphere, often used in space exploration or controlled scientific experiments.

Q5: Compute the Balance in Hot's Investment in

Q8: Prepare a partial Balance Sheet for Canada

Q28: Bequests are normally not recorded until:<br>A)the person

Q37: A p-value of 1% for the intercept

Q48: Using only the Revenue test,which of the

Q59: Which of the following is the most

Q65: Ruben, Inc. is a management consulting firm

Q86: The textbook defined open-ended problems as problems

Q156: Stacy Kuh, the manager of the Ice

Q165: All of the following are true about