The following information pertains to questions 53 through 55 inclusively.Analysis and calculations should be made under current Canadian GAAP.

Alcor and Vax Inc.formed a joint venture on January 1,2010 called Inventure Inc.Alcor and Vax each hold a 50% in the venture and share equally in any profits or losses arising from the venture.

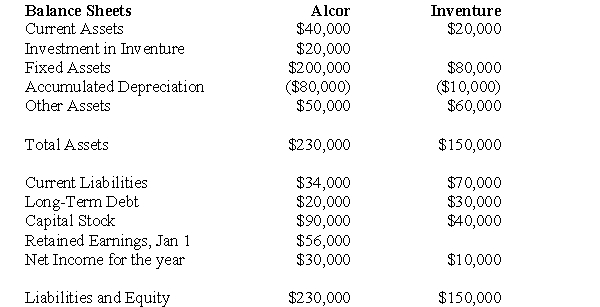

The following statements were prepared on December 31,2010.  Other Information:

Other Information:

During 2010,Inventure purchased $10,000 from Alcor.Alcor recorded a gross profit of $2,000 on these sales.

On December 31,2010,Inventure's inventories contained half of the merchandise purchased from Alcor.Alcor uses the Cost Method to account for its Investment in Inventure.Alcor wishes to comply with Section 3055 of the CICA Handbook.An income tax allocation rate of 20% applies.

-Using only the Revenue test,which of the following segment(s) would be reportable?

Definitions:

Contract Law

The area of law that deals with the creation and enforcement of agreements between parties, outlining the legal obligations and duties arising from agreements.

Agency Relationship

A fiduciary relationship in which one party (agent) acts on behalf of and under the control of another party (principal) in dealing with third parties.

Sales Representative

A person employed to sell products or services for a company, often directly to customers.

Percent Discount

A reduction in price, usually calculated as a certain percentage of the original price.

Q4: The focus of the Consolidated Financial Statements

Q5: English borrows words from many other languages.<br>A)

Q7: Prepare journal entries for these transactions,using the

Q17: At what amount (in Canadian Dollars)would RXN's

Q20: Prepare Larmer's December 31,2011 Consolidated Balance Sheet.

Q25: According to the CICA Handbook and current

Q28: Explain how the amount was derived for

Q39: What would be the carrying value of

Q85: Discretionary costs reflect:<br>A)The costs that managers incur

Q164: Managers go through a series of questions