The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

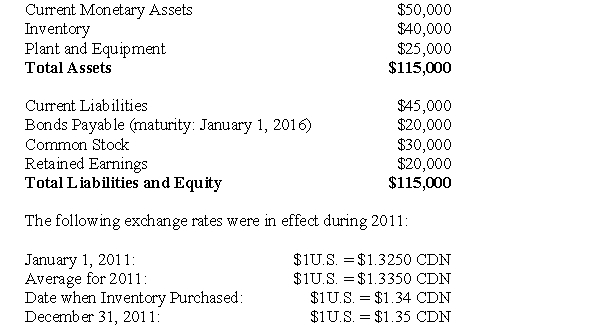

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

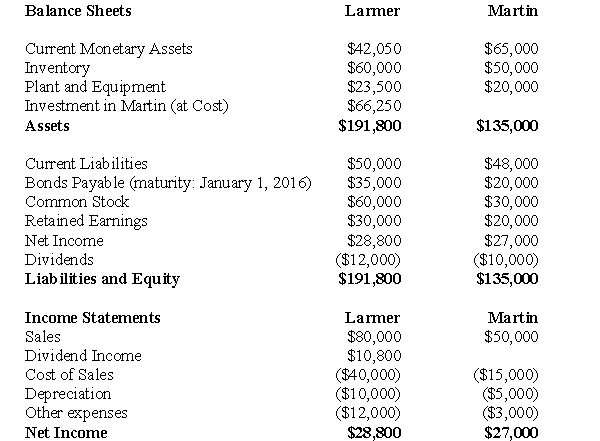

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Translate Martin's December 31,2011 Balance Sheet into Canadian dollars.

Definitions:

Stress Management Training

Educational programs or techniques designed to help individuals cope with and reduce stress levels.

Stressors

Factors or conditions that induce stress or tension in individuals.

Objectives

Specific, measurable, achievable, relevant, and time-bound goals or targets that an individual or organization aims to accomplish.

Progressive Muscle Relaxation

A relaxation technique that involves tensing and then relaxing each muscle group progressively to reduce stress and physical tension.

Q16: Assume that Stanton's Equipment,Land and Trademark on

Q26: What is the amount of the Liability

Q28: Explain how the amount was derived for

Q31: Which of the following rates would be

Q50: List the assumptions made when a linear

Q61: Blackmon Co. is deciding between two compensation

Q76: Which of the following often prevents managers

Q82: The new cost analyst in your accounting

Q84: Suppose the current average cost per km

Q113: FTH Corporation produces and sells two products: