The following information pertains to questions

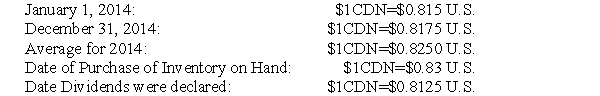

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

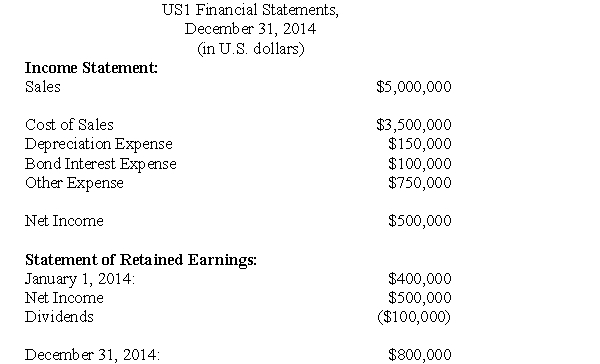

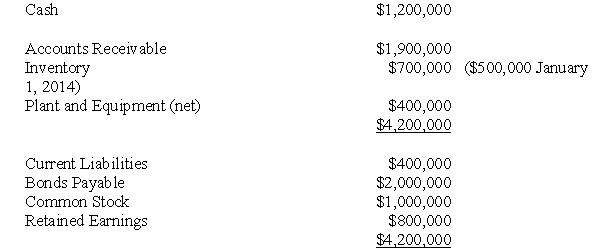

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's other expenses?

Definitions:

Earnings Per Share

Earnings per share (EPS) is a financial metric that represents the portion of a company's profit allocated to each outstanding share of common stock, indicating the company's profitability.

Excess Cash

The amount of cash holdings that exceed the normal operational needs of a company.

Stock Repurchase

A business operation where a company repurchases its shares from the market, leading to a decrease in the total number of shares available.

Repurchase

Another method used to pay out a firm’s earnings to its owners, which provides more preferable tax treatment than dividends.

Q1: Any excess of fair value over book

Q12: Prepare Plax's Consolidated Income Statement for the

Q24: The breakeven point can be defined as:<br>A)The

Q24: What is the amount of RXN's foreign

Q32: What is the amount of Consolidated Retained

Q53: Prepare a partial Balance Sheet for Maplehauff

Q79: When estimating future costs, information quality is

Q88: A firm's production is expected to show

Q108: The Pierson Co. has the following unit

Q156: Stacy Kuh, the manager of the Ice