The following information pertains to questions

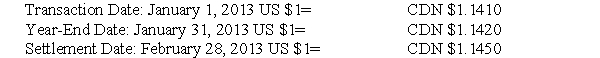

On January 1,2013,Canadian Music International (CMI) ,a manufacturer of high-end recording equipment based in Toronto,shipped $120,000 worth of inventory to its main U.S.distributor in Chicago,with full payment of these goods to be paid by February 28,2013.CMI has a January 31 year end.A list of significant dates and exchange rates is shown below.  The invoice price billed by CMI was $120,000 U.S.

The invoice price billed by CMI was $120,000 U.S.

-What is the TOTAL amount of CMI's foreign exchange gain or loss on this transaction?

Definitions:

Deteriorating Earnings

A condition where a company experiences a decline in profitability and earnings over time.

Dividend Income

Income received from owning shares of a company that pays dividends, which is a portion of the company's earnings distributed to shareholders.

Dividend Preference Theory

A theory that suggests investors prefer dividends over future capital gains because dividends provide certainty.

"A bird in hand"

A principle implying that it is better to have a certain, smaller benefit now than a possibility of a greater benefit later, often used in dividend policy discussions.

Q3: Approximately what percentage of the non-controlling interest

Q4: Which of the following statements is correct

Q6: The amount of goodwill arising from this

Q10: Prepare Brand X's Consolidated Balance Sheet as

Q26: Pet Snacks Company has 500 kg of

Q43: The amount appearing under equipment on the

Q54: Compute the Consolidated Cost of Goods Sold

Q65: The new IASB standard issued with respect

Q76: Which of the following often prevents managers

Q91: FCS Corporation's accounting manager, Gail, is in