The following information pertains to questions

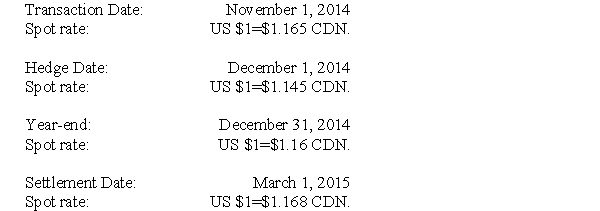

RXN's year-end is on December 31.On November 1,2014 when the U.S.dollar was worth $1.165 CDN,RXN sold merchandise to an American client for $300,000.Full payment of this invoice was expected by January 31,2015.On December 1,the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN.

In order to minimize its Foreign Exchange risk and exposure,RXN entered into a contract with its bank on December 1,2014 to deliver $300,000 U.S.in three months time.The spot rate at year-end was $1.16 CDN.On March 1,2015,RXN received the $300,000 U.S.from its client and settled its contract with the bank.

Significant dates pertaining to this transaction are as follows:

-What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

Definitions:

Homeowners' Policies

Insurance contracts that provide coverage for damage to a homeowner's property, possessions, and liability.

Insurance Salespeople

Professionals who specialize in selling insurance policies, advising clients on risk management, and providing financial planning services.

Ancestral History

The study or account of ancestors and family lineage, often including cultural and social backgrounds.

Fear of Flying

An anxiety disorder characterized by an overwhelming dread of air travel, impacting an individual's ability to fly.

Q1: Blackmon Co. is deciding between two compensation

Q12: Which of the following statements is correct?<br>A)Under

Q13: Which of the following statements best describes

Q19: What would be the non-controlling interest amount

Q21: Which of the following statements is correct

Q30: Assuming that X Inc.used the equity method,what

Q40: Prepare Plax's Consolidated Statement of Financial Position

Q45: What would be Whine's ownership interest in

Q86: The textbook defined open-ended problems as problems

Q107: Jackie's Kennels is located in a small