inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

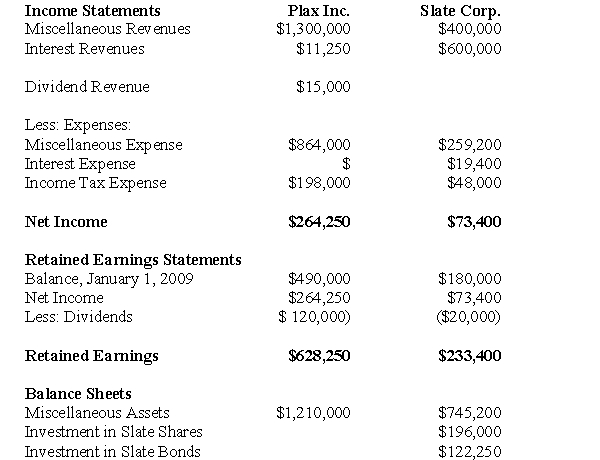

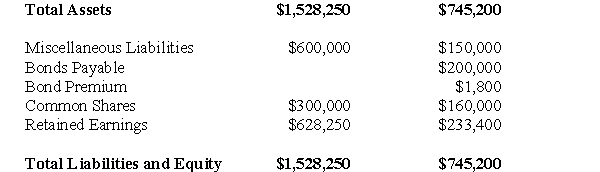

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare Plax's Consolidated Statement of Financial Position as at December 31,2009.

Definitions:

Mucous Membranes

The moist tissue linings of various body cavities, including the mouth, nose, throat, and reproductive tract, that protect against infection.

Mechanical Barriers

Physical or structural methods used to prevent or control the entry or exit of harmful substances or organisms in a particular area.

Skin

The body's largest organ, serving as a protective barrier between the inside of the body and the external environment.

Immunoglobulin

Proteins in the blood plasma, also known as antibodies, which are crucial for the immune system's response against pathogens.

Q1: The maximum amortization period specified by Section

Q9: What is the amount of the hedge

Q11: What would be the amount of cash

Q13: Ethical behavior is required of every employee

Q15: Under the Current Rate Method:<br>A)Transaction exposure is

Q24: Under IFRS 10,when can a venturer recognize

Q26: Asset revaluations,unlike in Canada,have been acceptable in

Q31: Your company has an important subsidiary in

Q43: What is the journal entry required to

Q50: Approximately what percentage of the non-controlling interest