The following information pertains to questions

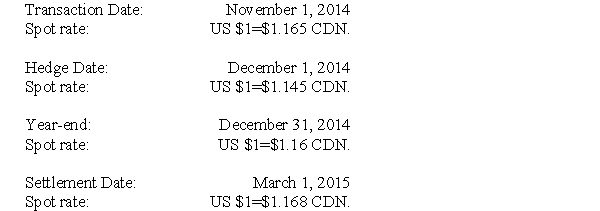

RXN's year-end is on December 31.On November 1,2014 when the U.S.dollar was worth $1.165 CDN,RXN sold merchandise to an American client for $300,000.Full payment of this invoice was expected by January 31,2015.On December 1,the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN.

In order to minimize its Foreign Exchange risk and exposure,RXN entered into a contract with its bank on December 1,2014 to deliver $300,000 U.S.in three months time.The spot rate at year-end was $1.16 CDN.On March 1,2015,RXN received the $300,000 U.S.from its client and settled its contract with the bank.

Significant dates pertaining to this transaction are as follows:

-What is the amount of the discount recorded on the contract?

Definitions:

PRSA Code Provisions

Guidelines and ethical principles provided by the Public Relations Society of America to govern the professional conduct of its members.

Disclosure of Information

The act of making information known or public, especially that which was previously confidential.

Improper Conduct

Improper conduct refers to actions or behavior that are unethical, illegal, or not in line with established standards or expectations.

Societies

Groups of individuals involved in persistent social interaction, or a large social grouping sharing the same geographical or virtual territory, subject to the same political authority and dominant cultural expectations.

Q2: What is the amount of the discount

Q4: ABC Manufacturing wants to determine whether its

Q8: What is the amount of the Deferred

Q12: Which of the following statements is FALSE?<br>A)If

Q12: What is the Consolidated Net Income for

Q13: List and describe three methods for developing

Q14: What would be the balance in the

Q16: Under the Balance Sheet approach,the differences between

Q135: All of the following are true about

Q177: ABC Co. has fixed costs of $50,000