The following information pertains to questions

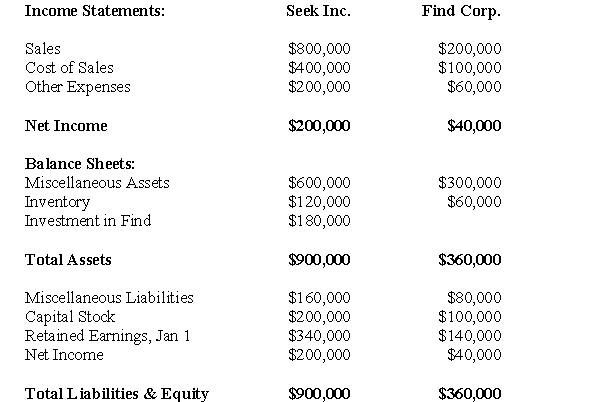

Find Corp.is a joint venture in which Seek Inc.has a 20% interest.Seek uses the equity method to account for its investment but has yet to make any journal entries for 2010.The financial statements of both companies are shown below on December 31,2010.  During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

Seek shall use the proportionate consolidation method (current Canadian GAAP) to report its investment in Find Corp.for 2010.Both companies are subject to 40% tax rate.

-What is the total amount of intercompany sales and purchases that must be eliminated from the financial statements?

Definitions:

Unemployment Figures

Statistical data representing the percentage or number of individuals in the labor force who are not currently employed but are seeking employment.

Market Opportunity

A favorable condition in the market that a business can exploit to grow its sales and increase profitability.

Proactive Change

Initiating changes or actions in anticipation of future problems or opportunities, rather than reacting to events after they happen.

Managing Change

The process of steering or directing an organization through a transition, such as a restructuring, technology implementation, or shift in culture or strategy.

Q2: Coffee Cart sells a variety of hot

Q8: Beta Corp.owns 80% of Gamma Corp.The Consolidated

Q11: What would be the amount of cash

Q34: Great Western Manufacturing Inc.("GWM")was acquired by Great

Q34: The cumulative average-time learning curve can be

Q36: The amount of depreciation expense appearing on

Q44: Using Push Down accounting is:<br>A)permissible under IFRSs.<br>B)is

Q47: Which of the following journal entries would

Q57: Assuming once again that GNR owned 80%

Q109: The average cost to produce 10,000 units