The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

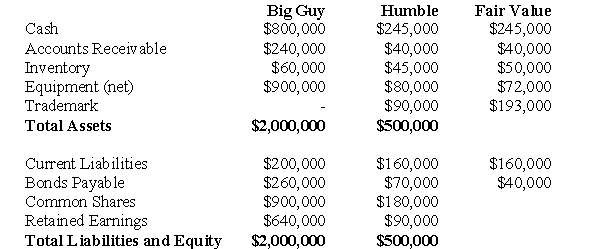

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

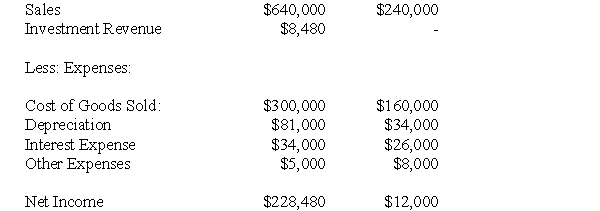

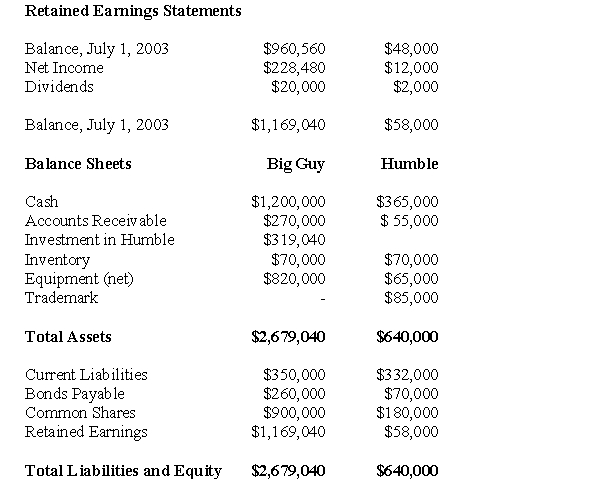

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of depreciation expense appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Test Statistic

A number derived from sample observations in a hypothesis test, essential for determining the rejection of the null hypothesis.

Null Hypothesis

A default hypothesis that there is no significant difference or effect, used as a starting point for statistical testing.

Type I Error

A Type I error occurs when a true null hypothesis is incorrectly rejected.

Q16: Ignoring taxes,what is the total amount of

Q19: Income-smoothing has been applied to a German

Q24: The band began to march down the

Q32: The following are selected transactions from Helpers

Q35: In which fund would the purchase of

Q39: What would be the carrying value of

Q40: Prepare Plax's Consolidated Statement of Financial Position

Q45: Prepare the December 31,2013 Balance Sheet Presentation

Q59: What would be Errant's journal entry to

Q62: In a Business Combination involving two companies,when