Analysis and calculations should be based on the requirements of current Canadian GAAP.

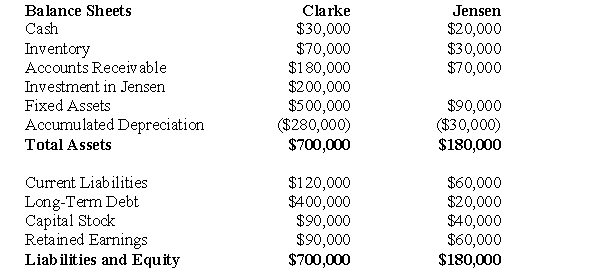

The following balance sheets have been prepared on December 31,2010 for Clarke Corp.and Jensen Inc.  Additional Information:

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen,which it acquired on January 1,2007.On that date,Jensen's retained earnings were $20,000.The acquisition differential was fully amortized by the end of 2010.

Clarke sold Land to Jensen during 1999 and recorded a $15,000 gain on the sale.Clarke is still using this Land.Clarke's December 31,2010 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2010 interest-free.Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

-Prepare a Balance Sheet for Clarke on December 31,2010 in accordance with current Canadian GAAP,assuming that Clarke's Investment in Jensen is a joint venture investment.

Definitions:

Pollutants

Are substances or elements that contaminate the environment, causing harm or discomfort to living organisms.

Quantify

To express or measure the quantity of something.

Property Rights

Legal rights to possess, use, and dispose of assets or land.

Polluters

Entities that emit harmful substances into the environment, contributing to pollution.

Q15: The Shareholder Equity section of Parent's Consolidated

Q25: Prepare a schedule of Realized and Unrealized

Q33: Which of the following statements is correct?<br>A)Since

Q38: Ignoring taxes,what is the total amount of

Q49: Assuming that Parent Company purchased 80% of

Q51: Which of the following would NOT be

Q51: Which of the following statements is correct?<br>A)In

Q54: Because the use of the Pooling of

Q154: Variable costs:<br>A)Do not vary in total within

Q156: Stacy Kuh, the manager of the Ice