Analysis and calculations should be made based on current Canadian GAAP.

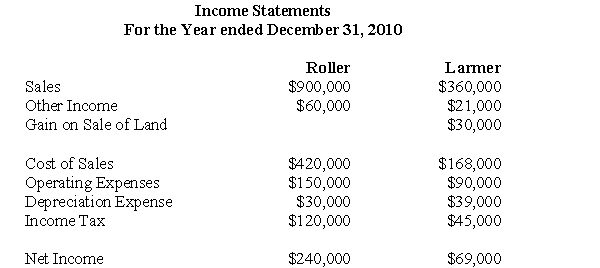

The following are the 2010 Income Statements of Roller Corp and Larmer Corp.  Other Information:

Other Information:

During 2010 Larmer paid dividends of $24,000.Roller acquired its 30% stake in Roller at a cost of $400,000 and uses the cost method to account for its investment.Roller's investment in Larmer shall not be considered a control investment.

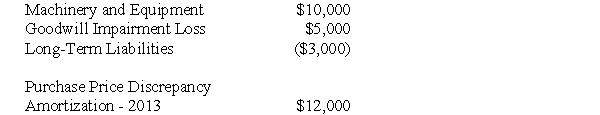

The acquisition differential amortization schedule showed the following write-off for 2010:  During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

In 2010,Roller sold Land to Larmer and recorded a profit of $10,000 on the sale.During 2010,Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

-Assuming that Larmer is NOT a joint venture and that it is also NOT a portfolio investment,prepare Roller's 2010 Income Statement in accordance with current Canadian GAAP.

Definitions:

Two Factor Authentication

An additional security process where two different authentication methods are used to verify the identity of an individual trying to access services or data.

Biometric Security

Security measures that use biological traits, such as fingerprints, facial recognition, or iris scans, to authenticate individuals' identities.

Data Mining

The practice of examining large pre-existing databases in order to generate new information or insights.

Trojan

A type of malicious software designed to appear legitimate to gain access to user systems and cause harm or steal information.

Q10: What is the amount of the gain

Q16: Assume that Stanton's Equipment,Land and Trademark on

Q16: Which of the following statements is TRUE

Q30: Which of the following statements is correct?<br>A)If

Q40: Company Inc.owns all of the outstanding voting

Q44: Assume that X Corp.controls X Corp.X constantly

Q46: What would be Errant's journal entry to

Q57: Assuming once again that GNR owned 80%

Q60: The amount of depreciation expense appearing on

Q72: Suppose that you worked for Sonic Inc.and