The following information pertains to questions

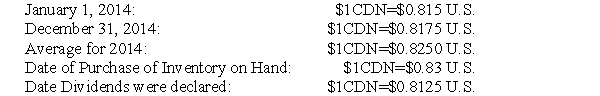

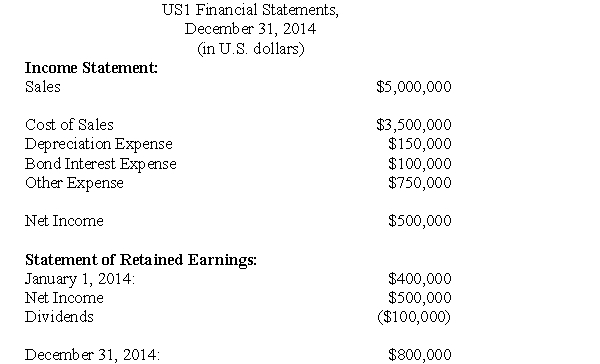

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

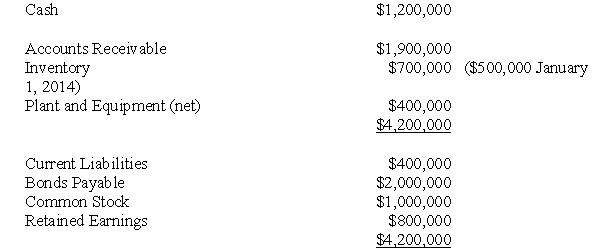

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-What is the amount of the gain or loss arising from translation?

Definitions:

DNA Molecule

The carrier of genetic information, consisting of two long chains of nucleotides twisted into a double helix.

Promoter

In DNA, a sequence that is a site where RNA polymerase binds and begins transcription.

Codons

Sequences of three nucleotides in mRNA that specify the addition of a specific amino acid or the termination of translation.

Amino Acid

Organic compounds that serve as the building blocks of proteins, necessary for the growth and repair of body tissues.

Q26: What is the after-tax dollar value of

Q31: What was the pre-tax gain or loss

Q37: A p-value of 1% for the intercept

Q38: What is the amount of non-controlling interest

Q40: Prepare Plax's Consolidated Statement of Financial Position

Q55: The elimination entry required to remove any

Q67: If the average cost decreases as volume

Q86: A firm with fixed costs of $61,500

Q134: The managers of Web Design Services Company

Q142: This year, Bigtree County made a $400,000