The following information pertains to questions

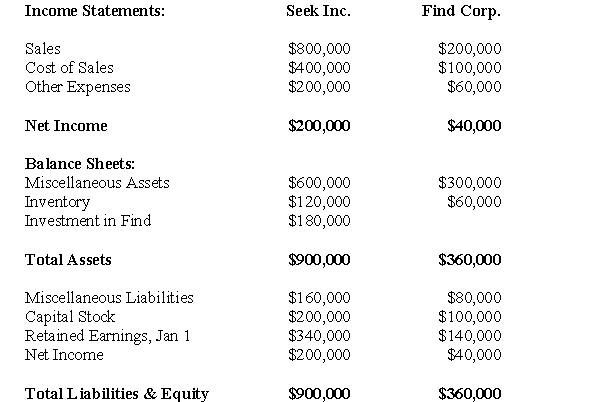

Find Corp.is a joint venture in which Seek Inc.has a 20% interest.Seek uses the equity method to account for its investment but has yet to make any journal entries for 2010.The financial statements of both companies are shown below on December 31,2010.  During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

Seek shall use the proportionate consolidation method (current Canadian GAAP) to report its investment in Find Corp.for 2010.Both companies are subject to 40% tax rate.

-What is the total amount of other expenses that would appear on the Consolidated Income Statement?

Definitions:

Authorized Stock

The upper limit of shares a corporation is allowed to issue, according to its founding documents.

Par Value

The nominal or face value of a stock or bond, as stated by the issuing company.

Common Stock

A type of security that represents ownership in a corporation, entitling the holder to vote on corporate matters and receive dividends.

Paid-In Capital

Represents the funds raised by a company through the sale of its own shares rather than through borrowed capital or earnings.

Q10: SLP Corporation produces and sells a single

Q15: Which of the following is/are LEAST likely

Q15: Irrelevant cash flows are:<br>A)Avoidable<br>B)Unavoidable<br>C)Objective<br>D)Subjective

Q34: What would be the carrying value of

Q36: Which of the following bodies is responsible

Q38: What would be the amount of the

Q55: List one assumption made when a linear

Q57: Assuming once again that GNR owned 80%

Q63: Assume that both companies would be wound

Q130: Past costs are irrelevant for both decision-making