The following information pertains to questions

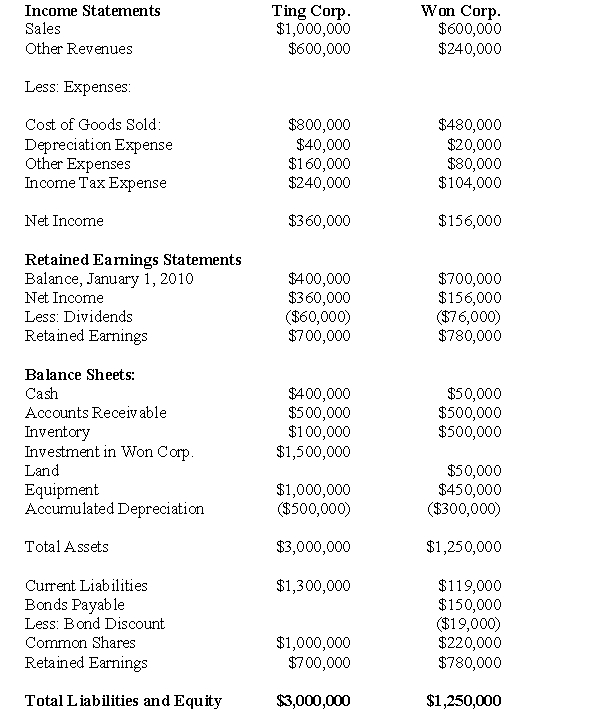

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-What would be the carrying value of the bonds payable appearing on Ting's December 31,2010 Consolidated Statement of Financial Position?

Definitions:

Functional Fixedness

A cognitive bias that limits a person's ability to use an object only in the way it is traditionally used.

Confirmation Bias

The habit of looking for, interpreting, prioritizing, and recalling data in a way that reinforces one's already held convictions or assumptions.

Gamble

The act of risking something of value on the outcome of an event in the hope of gaining something of greater value.

Hypotheses Forming

The process of creating an educated guess or proposition that attempts to explain certain phenomena or relationships, which can be tested through research or experimentation.

Q4: The prewriting above is<br>A) focused freewriting.<br>B) brainstorming.<br>C)

Q7: Assuming that X's Investment in Y qualifies

Q28: What would be the change in the

Q31: Assume that Mine Inc issued 10,000 shares

Q34: What would be the carrying value of

Q37: Consolidated Net Income for 2009 would be:<br>A)$69,150<br>B)$57,850<br>C)$58,000<br>D)$56,000

Q38: Which one of following is not a

Q47: Assume that two days after the acquisition,the

Q65: Ethical behavior is an individual obligation, but

Q66: The same facts apply,but in this case