The following information pertains to questions 53 through 55 inclusively.Analysis and calculations should be made under current Canadian GAAP.

Alcor and Vax Inc.formed a joint venture on January 1,2010 called Inventure Inc.Alcor and Vax each hold a 50% in the venture and share equally in any profits or losses arising from the venture.

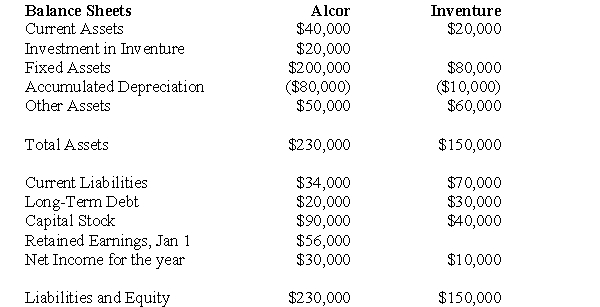

The following statements were prepared on December 31,2010.  Other Information:

Other Information:

During 2010,Inventure purchased $10,000 from Alcor.Alcor recorded a gross profit of $2,000 on these sales.

On December 31,2010,Inventure's inventories contained half of the merchandise purchased from Alcor.Alcor uses the Cost Method to account for its Investment in Inventure.Alcor wishes to comply with Section 3055 of the CICA Handbook.An income tax allocation rate of 20% applies.

-Using only the Assets test,which of the following segment(s) would be reportable?

Definitions:

Standard Deviation

A measure of the amount of variation or dispersion of a set of values, indicating how much the values in the set deviate from the mean.

Data

Factual information used for analysis or calculation, often numeric.

Data

Information collected for reference, analysis, or calculation, typically used to study relationships and trends.

Data

Quantitative or qualitative information collected for reference or analysis.

Q3: HRN Enterprises Inc purchases 80% of the

Q11: Ignoring taxes,what is the total amount of

Q23: What is the amount of CMI's foreign

Q23: The difference between the Investor's cost and

Q25: Prepare a schedule of Realized and Unrealized

Q28: Explain how the amount was derived for

Q32: A company has decided to purchase 100%

Q46: If we want to estimate the cost

Q49: Explain how scatter plots are used in

Q57: Assuming once again that GNR owned 80%