Analysis and calculations should be based on the requirements of current Canadian GAAP.

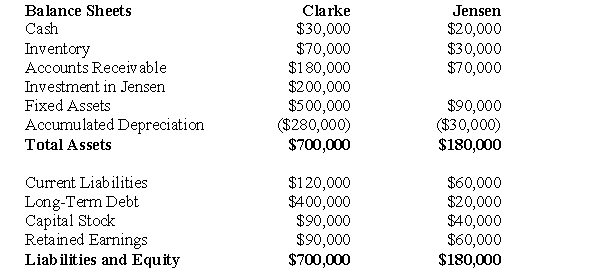

The following balance sheets have been prepared on December 31,2010 for Clarke Corp.and Jensen Inc.  Additional Information:

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen,which it acquired on January 1,2007.On that date,Jensen's retained earnings were $20,000.The acquisition differential was fully amortized by the end of 2010.

Clarke sold Land to Jensen during 1999 and recorded a $15,000 gain on the sale.Clarke is still using this Land.Clarke's December 31,2010 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2010 interest-free.Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

-Prepare a Balance Sheet for Clarke on December 31,2010 in accordance with current Canadian GAAP,assuming that Clarke's Investment in Jensen is a joint venture investment.

Definitions:

Manic State

A period of abnormally elevated or irritable mood, arousal, and energy levels, often seen in bipolar disorder.

Psychosis

A significant psychological disorder characterized by such a profound disruption in thinking and emotional regulation that the individual loses touch with the outside world.

High Energy Level

A state of having abundant physical or mental strength, allowing for sustained activity or productivity.

Positive Self-Image

An individual's subjective perception of themselves, characterized by confidence, respect, and a positive outlook on one's abilities and attributes.

Q19: A not-for-profit organization is required to record

Q25: How would the not-for-profit organization report each

Q43: You work for a company that manufactures

Q47: The NET amount appearing on Big Guy's

Q49: Prepare a Balance Sheet for Clarke on

Q68: Organizational core competencies can include:<br>A)A mission statement<br>B)Patents,

Q72: Frank is considering transportation modes to a

Q79: Management decisions require monitoring over time for

Q85: Discretionary costs reflect:<br>A)The costs that managers incur

Q92: The incremental cash flow approach:<br>A)Analyzes the additional