The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

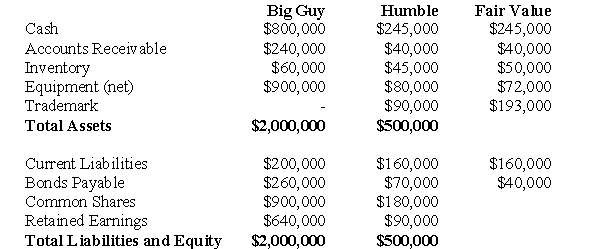

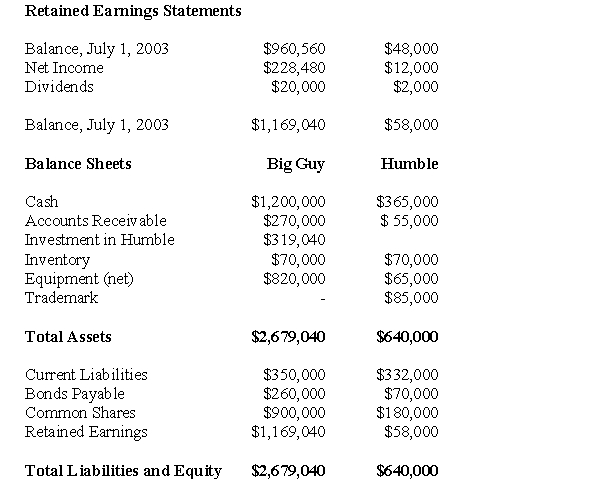

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

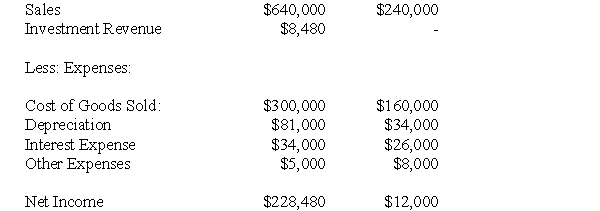

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The NET amount appearing on Big Guy's Consolidated Balance Sheet for equipment as at July 1,2004 would be:

Definitions:

Kinesthetic Sense

A sense that detects bodily position, weight, or movement of the muscles, tendons, and joints.

Fast Pathway

A term related to neurotransmission, describing a route through which some neural signals travel faster than others.

Cerebral Cortex

The exterior layer of the cerebrum's neural tissue, crucial for functions like memory, attention, perception, cognition, awareness, thinking, language, and consciousness.

Limbic System

A complex system of nerves and networks in the brain, involved with instinct and mood. It controls the basic emotions and drives.

Q7: What is the amount of miscellaneous liabilities

Q8: Explain why the use of management accounting

Q14: Which of the following rates would be

Q22: Assuming once again that the Proprietary Theory

Q25: Types of tests<br>A) multiple-choice test<br>B) math test<br>C)

Q26: On what basis does the writer classify

Q39: Approximately what percentage of the non-controlling interest

Q47: Assume that two days after the acquisition,the

Q48: Which of the following statements accurately describes

Q50: Which of the following is the correct