Calculations and analysis should be based on current Canadian GAAP.

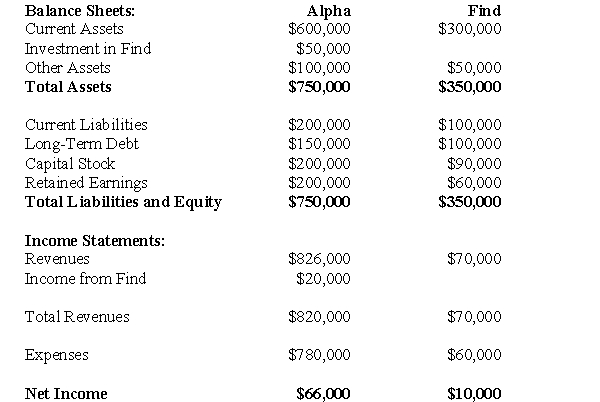

On January 1,2006,Alpha,Beta and Gamma agree to enter into a joint venture and thereby formed Find Corp.Alpha contributed 40% of the assets to the venture,which was also its stake in the venture.Presented below are the financial statements of Alpha and Find as at December 31,2010:  Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha supplies Find with an important component that is used by Find as it carries out its business activities.The December 31,2010 inventory of Find contains items purchase from Alpha on which Alpha recorded a gross profit of $10,000.Intercompany sales are always priced to provide the seller with a gross margin of 40% on sales.Both companies are subject to a tax rate of 40%.On December 31,2010,Find still owed $5,000 to Alpha for unpaid invoices.

-Prepare Alpha's Balance Sheet as at December 31,2010.

Definitions:

Unsystematic Risk

The risk associated with a particular company or industry, as opposed to the market as a whole; also known as specific or idiosyncratic risk.

Market Level

The current status or position of prices, stocks, or commodities within a particular market.

Systematic Risk

Market-wide or market segment-specific dangers that cannot be eliminated by diversifying one's investment portfolio.

Beta

Beta is a measure of a stock's volatility in relation to the overall market, indicating the stock's risk level compared to the market average.

Q7: Prepare journal entries for these transactions,using the

Q27: What is the required adjustment to ABC's

Q31: Any goodwill on the subsidiary's company's books

Q46: Ignoring taxes,what is the total amount of

Q46: What amount of sales revenue would appear

Q48: Appendix A of IFRS 3 provides an

Q50: Which of the following is the correct

Q56: Compute Martin's exchange gain or loss for

Q76: Simple regression analysis differs from multiple regression

Q110: Following are the results from two different