The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

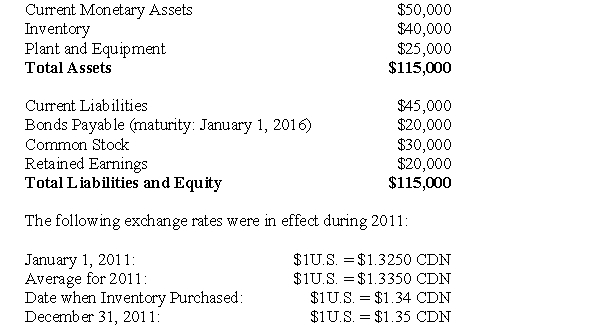

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

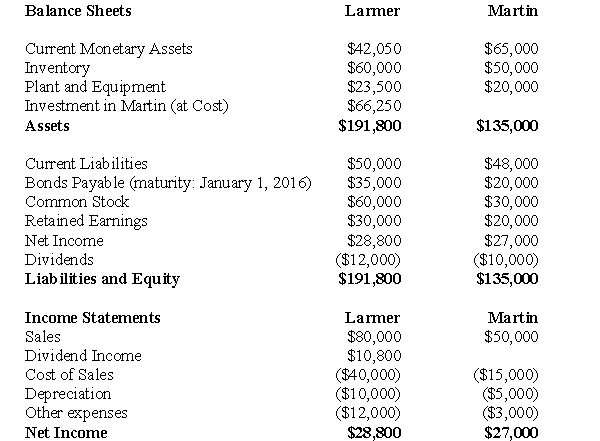

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Compute Martin's exchange gain or loss for 2011.

Definitions:

Minimum Cash Balance

The lowest level of cash that a company or individual aims to maintain to meet operational and emergency needs.

Cash Budget

A financial plan that estimates cash inflows and outflows over a specific period to manage liquidity and ensure financial stability.

Borrow

The act of receiving funds from another party under the agreement to return the principal amount along with interest.

Cash Budget

A financial plan that estimates cash inflows and outflows over a specific period, used to manage liquidity and ensure financial stability.

Q5: Choosing and implementing a solution to a

Q18: The amount of other expenses appearing on

Q18: Compute the amount of income tax that

Q19: What would be the non-controlling interest amount

Q26: What is the after-tax dollar value of

Q51: Non-Controlling Interest is presented in the Shareholders'

Q63: Cost accounting is all of the following

Q72: Milano Company has an average overhead cost

Q143: Which of the following methods of estimating

Q171: Which of the following techniques relies on