The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

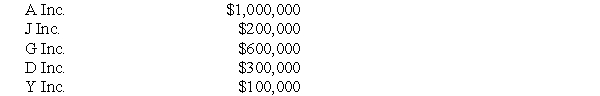

The Net Incomes for these companies for the year ended December 31,2009 were as follows:  Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

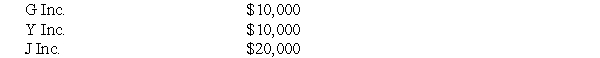

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

-Approximately what percentage of the non-controlling interest was due to J's own earnings?

Definitions:

Dialkyl Ethers

Organic compounds consisting of an oxygen atom bonded to two alkyl groups, often characterized by their ether functional group, R-O-R'.

IUPAC

International Union of Pure and Applied Chemistry, an organization that sets standards for naming chemical compounds.

Epoxypentan-1-ol

An organic compound featuring a five-carbon chain with an epoxide ring (a three-membered ring consisting of an oxygen atom and two carbon atoms) and a hydroxyl group at the first carbon.

Hydroxyethyl

A functional group or moiety featuring an ethyl backbone attached to a hydroxyl group, often represented as -CH2CH2OH.

Q17: Zen Inc.owns 35% of Sun Inc's voting

Q22: Under which of the following Theories is

Q27: Information gathered outside the organization includes:<br>A)Customer preferences<br>B)Product

Q27: Select the correct order for the steps

Q30: Which of the following statements is correct?<br>A)If

Q31: What was the pre-tax gain or loss

Q43: Which of the following rates would be

Q71: Assume that the facts provided above with

Q126: If you create a scatter plot of

Q164: Managers go through a series of questions