The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

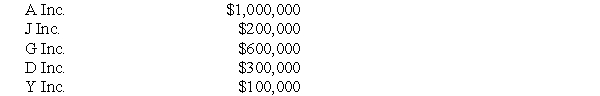

The Net Incomes for these companies for the year ended December 31,2009 were as follows:  Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

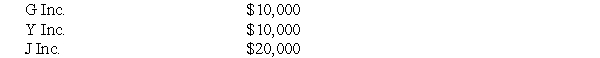

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

-Approximately what percentage of the non-controlling interest was due to Y's own earnings?

Definitions:

Prohibits Assignment

A clause or legal principle that prevents the transfer of a contract or right from one party to another.

Misrepresentation

The act of providing false or misleading information about a material fact in a transaction.

Contract Price

The amount of money agreed upon by parties involved in a contract for services or goods to be provided or delivered.

Delegatee

A person or party that is designated to act or make decisions on behalf of another, typically in a specified capacity or for particular issues.

Q3: What would be the non-controlling interest amount

Q4: What would be the balance in the

Q33: Translate Wilsen's 2014 Income Statement.

Q38: What approach did Canada decide to take

Q44: Accounting information is used to monitor operations

Q57: Compute the carrying value of the investment

Q63: Following are the income statements for the

Q65: Ethical behavior is an individual obligation, but

Q79: When estimating future costs, information quality is

Q134: The managers of Web Design Services Company