The following information pertains to questions

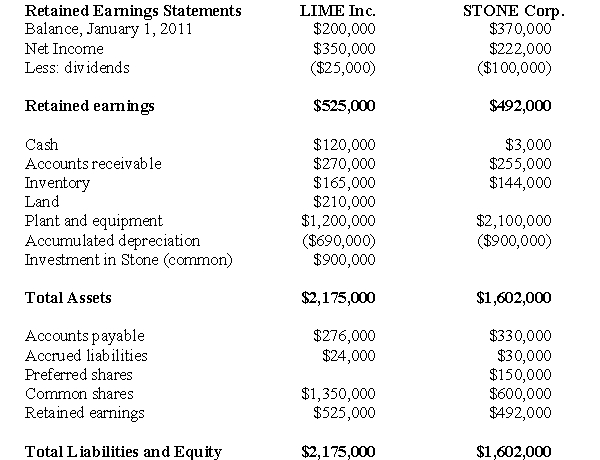

The financial statements of Lime Inc.and its subsidiary Stone Corp.on December 31,2011 are shown below:  Other Information:

Other Information:

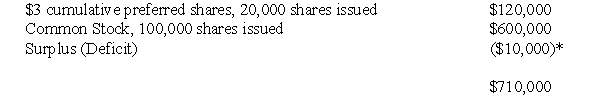

On January 1,2008 Stone's balance sheet showed the following shareholders equity:  On this date,Lime acquired 80,000 common shares for $900,000.

On this date,Lime acquired 80,000 common shares for $900,000.

* Stone's preferred share dividends were one year in arrears on that date.

Stone's Fair Values approximated its book values on that date with the following exceptions:

Inventory had a fair value that was $30,000 higher than its book value.Plant and equipment had a fair value $10,000 lower than their book value.

The plant and equipment had an estimated remaining useful life of 10 years from the date of acquisition.

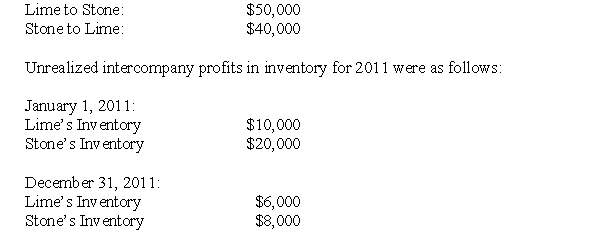

Intercompany sales of inventory for the year were as follows:  On January 1,2009,Stone sold equipment to Lime for $30,000.The equipment had a carrying value of $25,000 on that date and an estimated useful life of 3 years.The inventory on hand at the start of 2011 was sold to outsiders during the year.Both companies are subject to a tax rate of 40%.There were no dividends in arrears on December 31,2011.Lime uses the cost method to account for its investment in Stone.

On January 1,2009,Stone sold equipment to Lime for $30,000.The equipment had a carrying value of $25,000 on that date and an estimated useful life of 3 years.The inventory on hand at the start of 2011 was sold to outsiders during the year.Both companies are subject to a tax rate of 40%.There were no dividends in arrears on December 31,2011.Lime uses the cost method to account for its investment in Stone.

-Prepare Lime's December 31,2011 Consolidated Balance Sheet.

Definitions:

Standard Methodologies

Established, regular procedures or techniques used across a particular industry or field.

Deal-Making Process

The series of steps involved in negotiating and finalizing agreements between parties, often in business contexts.

Legal Advice

Guidance given by a legal professional regarding the law or legal proceedings relevant to a client's specific situation.

Accounting Advice

Professional recommendations or guidance concerning the financial management, practices, and recording of a business or individual's affairs.

Q9: Which of the following is a characteristic

Q10: At what value did CMI record the

Q24: Assume that the following draft balance sheet

Q34: Prepare a schedule of intercompany items as

Q38: What approach did Canada decide to take

Q38: Assuming the Entity Theory was applied,what would

Q41: Which of the following rates would be

Q54: A vision statement is one way to

Q57: What is the amount of after-tax profit

Q61: Company A makes a hostile take-over bid