Calculations and analysis should be based on current Canadian GAAP.

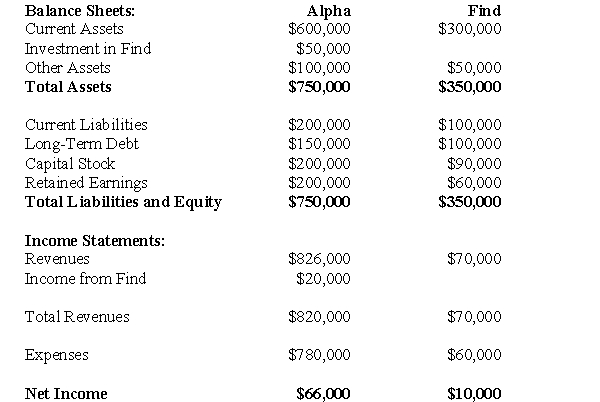

On January 1,2006,Alpha,Beta and Gamma agree to enter into a joint venture and thereby formed Find Corp.Alpha contributed 40% of the assets to the venture,which was also its stake in the venture.Presented below are the financial statements of Alpha and Find as at December 31,2010:  Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha supplies Find with an important component that is used by Find as it carries out its business activities.The December 31,2010 inventory of Find contains items purchase from Alpha on which Alpha recorded a gross profit of $10,000.Intercompany sales are always priced to provide the seller with a gross margin of 40% on sales.Both companies are subject to a tax rate of 40%.On December 31,2010,Find still owed $5,000 to Alpha for unpaid invoices.

-Prepare a schedule of intercompany items as at December 31,2010.

Definitions:

Problem Solve

The process of identifying, analyzing, and finding solutions for issues or challenges.

Manage Projects

Manage Projects involves planning, executing, and overseeing tasks to achieve specific objectives within defined scope, quality, time, and cost constraints.

Student Business Organization

A group formed by students within an educational institution focused on developing business skills, networking, and entrepreneurship.

Pre-Employment Testing

The process of evaluating potential employees’ abilities, personality, or suitability for a job before hiring them.

Q9: For the sake of simplicity,assume that US1's

Q13: Compute YIN's Goodwill at the date of

Q15: What would be the amount of the

Q18: Compute the amount of income tax that

Q19: What effect would the intercompany bond sale

Q41: Assuming that Plax uses the equity method,prepare

Q53: Under IFRS how are unrealized gains and

Q92: The incremental cash flow approach:<br>A)Analyzes the additional

Q95: The best source for determining historical costs

Q156: Stacy Kuh, the manager of the Ice