The following information pertains to questions

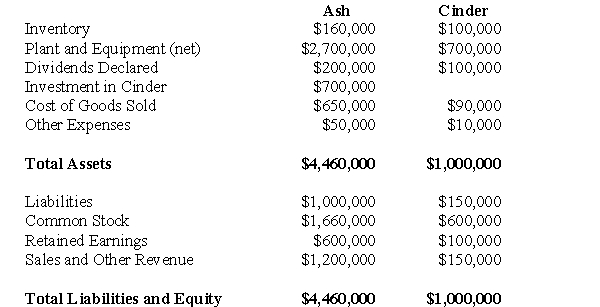

The trial balances of Ash Inc.and its subsidiary Cinder Corp.on December 31,2006 are shown below:  Other Information:

Other Information:

Ash acquired Cinder in three stages:

January 1,2006: Ash purchased 10,000 shares for $100,000.Cinder's Retained Earnings were $40,000 on that date.

January 1,2008: Ash purchased 30,000 shares for $450,000.Cinder's Retained Earnings were $80,000 on that date.

December 31,2009: Ash purchased 20,000 shares for $150,000.Cinder's Retained Earnings were $100,000 on that date.

Cinder was incorporated on January 1,2004.On that date,Cinder issued 100,000 voting shares.Any difference between the cost and book value for each acquisition is attributable entirely to trademarks,which are to be amortized over 5 years.The company has neither issued nor retired shares since the Date of Incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1,2008.These assets had a 10 year remaining life.

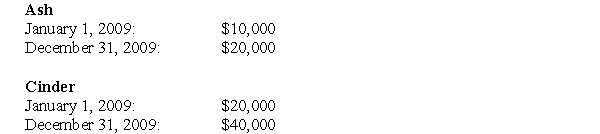

Intercompany Sales of Inventory amounted to $250,000.Unrealized inventory profits for each company are shown below for 2009.The amounts indicate the amount of profit in each company's inventory.  All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

-Prepare an acquisition differential amortization table since the acquisition date.

Definitions:

Costs of Capital

The cost of funds used for financing a business, often considered in terms of the weighted average cost of capital.

Required Rates of Return

The minimum returns investors expect from their investment, influencing their decision whether to invest.

Stocks or Bonds

Financial instruments that represent equity ownership in a company (stocks) or a fixed income security issued by corporations or governments (bonds).

Flotation Cost

The costs incurred by a company in issuing new securities, including underwriting fees, legal fees, and registration fees.

Q4: What would be the balance in the

Q4: This paragraph will be about my family.<br>A)

Q10: Which of the following is an alternative

Q17: Prepare a schedule showing the realized and

Q27: Select the correct order for the steps

Q29: Which of the following statements is correct?<br>A)Under

Q35: Under the new entity method,<br>A)the net assets

Q43: In your own words,explain what effect (if

Q49: What would be the amount appearing on

Q55: By how much would the non-controlling interest