The following information pertains to questions

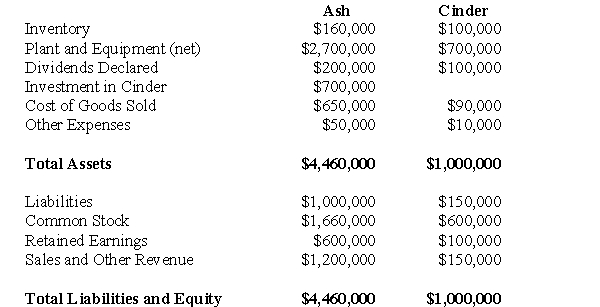

The trial balances of Ash Inc.and its subsidiary Cinder Corp.on December 31,2006 are shown below:  Other Information:

Other Information:

Ash acquired Cinder in three stages:

January 1,2006: Ash purchased 10,000 shares for $100,000.Cinder's Retained Earnings were $40,000 on that date.

January 1,2008: Ash purchased 30,000 shares for $450,000.Cinder's Retained Earnings were $80,000 on that date.

December 31,2009: Ash purchased 20,000 shares for $150,000.Cinder's Retained Earnings were $100,000 on that date.

Cinder was incorporated on January 1,2004.On that date,Cinder issued 100,000 voting shares.Any difference between the cost and book value for each acquisition is attributable entirely to trademarks,which are to be amortized over 5 years.The company has neither issued nor retired shares since the Date of Incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1,2008.These assets had a 10 year remaining life.

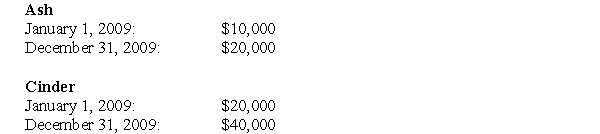

Intercompany Sales of Inventory amounted to $250,000.Unrealized inventory profits for each company are shown below for 2009.The amounts indicate the amount of profit in each company's inventory.  All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

-Compute consolidated inventory for Ash as at December 31,2009.

Definitions:

Harvest Issue

A problem or challenge encountered during the collection or gathering of agricultural crops.

Exit Mechanism

A strategy or method through which investors or business owners intend to exit their investment or business, often for the purpose of realizing profit or minimizing losses.

Sale or Acquisition

The process of transferring ownership of a company or its assets to another company or individual.

Rational Functions

Mathematical expressions that represent the ratio of two polynomials.

Q24: Assume that the following draft balance sheet

Q29: _. First of all, most people don't

Q35: Assuming that Errant uses the Cost Method,what

Q36: How is an Associate's Income from non-operating

Q39: Minh is a cost analyst for TRN

Q43: Which of the following is closest to

Q57: Roger is the controller of TPD Corporation.

Q58: What would be the carrying value of

Q67: If the average cost decreases as volume

Q78: Three different divisions of a toy manufacturing