The following information pertains to questions

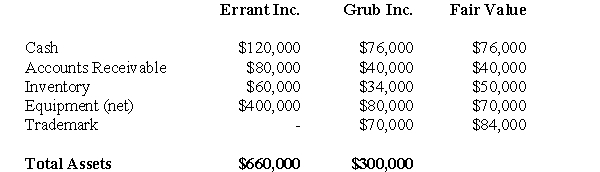

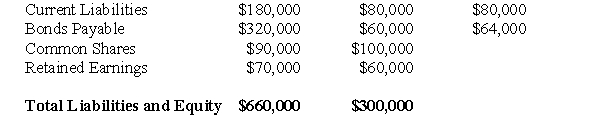

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

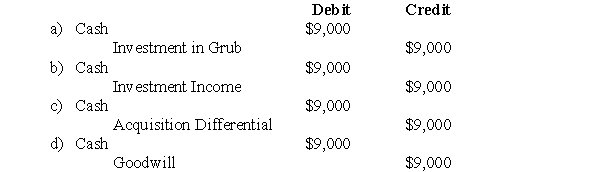

-Assuming that Errant uses the Cost Method,what would be the journal entry to record the dividends received by Errant during the year?

Definitions:

Information Provision

The act of supplying or making available information to individuals or groups.

Openers in Oral Presentations

Openers in oral presentations are introductory remarks or strategies used to capture the audience's attention at the beginning of a presentation.

Key Phrases

Important or significant words or groups of words that capture the essence of a topic, document, or discussion.

Oral Presentation

A spoken presentation given on a particular topic before an audience, usually as part of an educational or professional setting.

Q1: People who proofread on _ tend to

Q6: Company A owns all of the outstanding

Q8: Prepare a partial Balance Sheet for Canada

Q9: Many of my friends have made lifestyle

Q12: Assuming that the assets were purchased from

Q13: What would be the amount of the

Q23: In many countries,exceptions to the general rule

Q26: Asset revaluations,unlike in Canada,have been acceptable in

Q28: What would be the change in the

Q39: Which of the following rates would be