inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

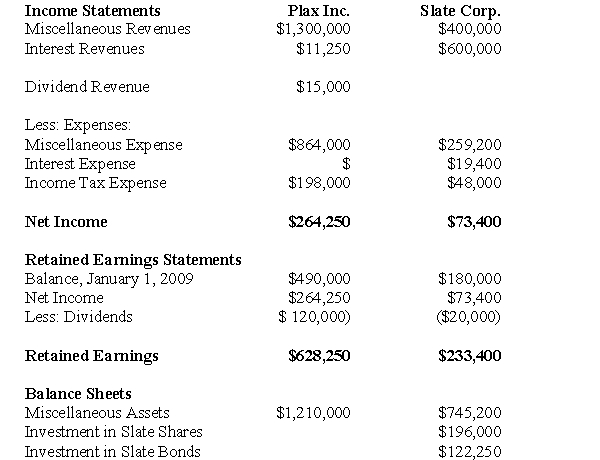

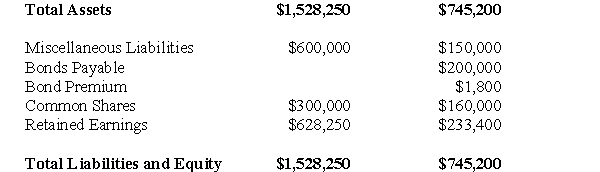

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Calculate the goodwill as at December 31,2009.

Definitions:

Standardized Personality Tests

Psychological assessments designed to measure and evaluate various aspects of a person's character and temperament using consistent and uniform procedures.

Positive Self-concept

An individual's perception of themselves in a favorable light, emphasizing strengths and positive qualities.

Actual Self

An individual's perception of their own attributes and characteristics at the present time.

Ideal Self

Represents an individual's conception of how they would like to be or what they strive to become.

Q6: What is the balance the Investment in

Q9: Which of the following is least likely

Q10: At what value did CMI record the

Q25: Under the Temporal Method:<br>A)The relationship of balance

Q30: Which of the following statements is correct?<br>A)If

Q33: Below is a plan for a comparison

Q56: The Goodwill arising from this Business Combination

Q71: Which of the following methods of accounting

Q85: Relevant cash flows are<br>A)Avoidable<br>B)Incremental<br>C)Both of the above<br>D)None

Q100: Cost accounting differs from financial accounting in