inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

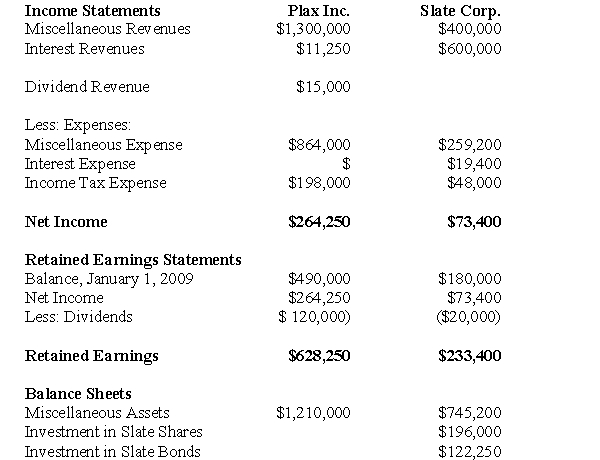

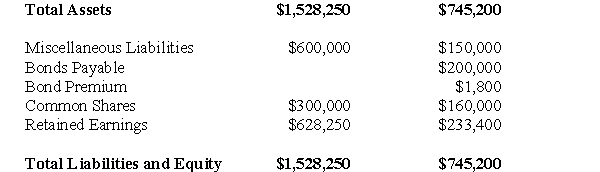

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a detailed calculation of Consolidated Net Income.Do not prepare an income statement for this requirement.

Definitions:

Requisite Authority

The necessary or required power, permission, or jurisdiction to perform an action or enforce a policy.

Power of Attorney

A legal document that allows one person to act on another's behalf in legal matters or financial transactions.

Representative Capacity

This refers to acting on behalf of another person or entity in a legal or official capacity, such as an attorney representing a client.

Authority

The authority to command, decide, and ensure compliance.

Q2: Prepare Brand X's Consolidated Balance Sheet as

Q3: Write out the algebraic formula that represents

Q11: This musical child changed name to Nicki

Q12: Which of the following statements is correct?<br>A)Under

Q14: The CICA Handbook is the handbook of

Q30: What is the amount of unrealized profits

Q35: The amount of common shares appearing on

Q40: Friendship is very important.<br>A) good topic sentence<br>B)

Q62: What is the amount of the Deferred

Q69: Which of the following methods is the