The following information pertains to questions

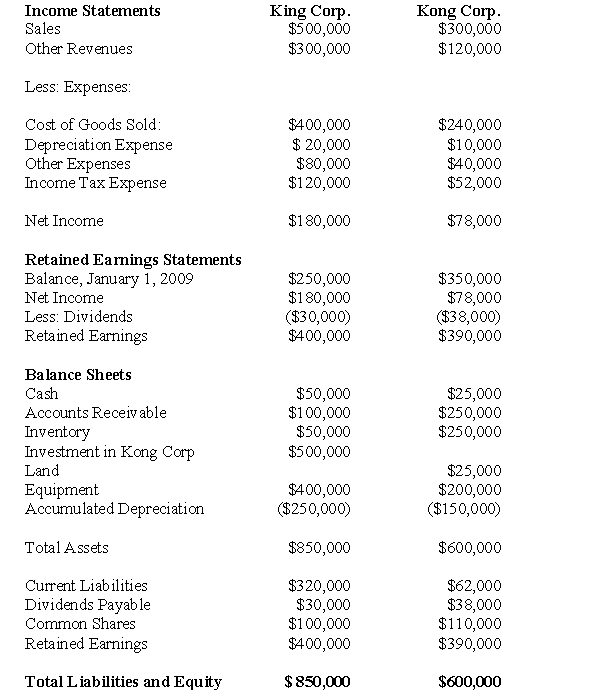

King Corp.owns 80% of Kong Corp and uses the cost method to account for its investment,which it acquired on January 1,2009.The Financial Statements of King Corp and Kong Corp for the Year ended December 31,2009 are shown below:  Other Information:

Other Information:

King sold a tract of Land to Kong at a profit of $10,000 during 2009.This land is still the property of Kong Corp.

On January 1,2009,Kong sold equipment to King at a price that was $20,000 higher than its book value.The equipment had a remaining useful life of 4 years from that date.

On January 1,2009 King's inventories contained items purchased from Kong for $10,000.This entire inventory was sold to outsiders during the year.Also during 2009,King sold Inventory to Kong for $50,000.Half this inventory is still in Kong's warehouse at year end.All sales are priced at a 25% mark-up above cost,regardless of whether the sales are internal or external.

Kong's Retained Earnings on the date of acquisition amounted to $250,000.There have been no changes to the company's common shares account.

Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a Fair value that was $20,000 higher than its book value.This inventory was sold to outsiders during 2009.

▫ A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000.The patent had an estimated useful life of 3 years.

▫ There was a goodwill impairment loss of $4,000 during 2009.

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization.

-What is the amount of unamortized acquisition differential on December 31,2009?

Definitions:

Income Statement

A financial document that shows a company's revenues and expenses over a specific period, culminating in the net income.

Balance Sheet

A financial statement that provides a snapshot of a company's financial position at a particular date, reporting assets, liabilities, and equity.

Total Assets

The sum of all resources owned by a company, valued in monetary terms.

Total Liabilities

The sum of all financial obligations or debts that a company owes to external parties.

Q4: What is the amount of Goodwill that

Q9: For the sake of simplicity,assume that US1's

Q14: Consequently, the expression "once in a blue

Q19: What amount of dividends would appear on

Q27: Making tortillas from scratch is actually a

Q37: What is the amount of foreign exchange

Q39: I want to become a nurse for

Q40: Maude is considering opening her own business,

Q49: Assuming that Parent Company purchased 80% of

Q145: Chabu's managerial accountant, Yi-Fan, is classifying the