The following information pertains to questions

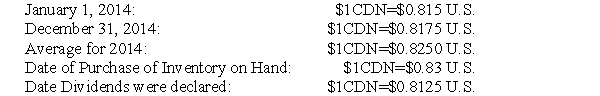

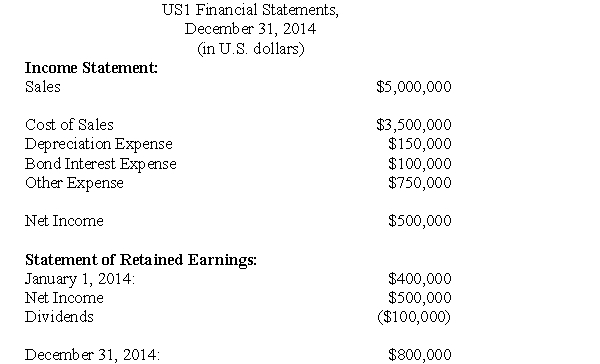

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

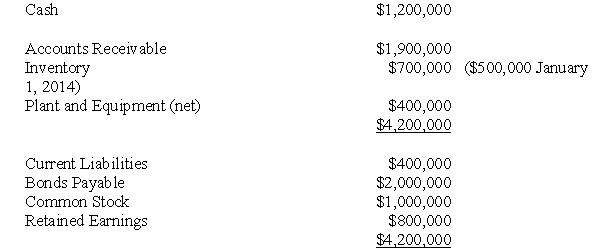

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-For the sake of simplicity,assume that US1's cost of sales was calculated to be $4,000,000 CDN.What is the amount of the gain or loss arising from translation?

Definitions:

Symbols

Are concrete objects or abstract terms that represent something else.

Abstraction Process

In thought or analysis, the method of isolating or separating properties or qualities from concrete realities to consider them independently.

Personal Terms

These terms relate to aspects or items specifically associated with or pertaining to an individual.

Intimate Relationships

Deeply personal and close connections between individuals, characterized by affection, love, trust, and mutual support.

Q13: Calculate Larmer's Consolidated Net Income for 2011.

Q24: Prepare the necessary journal entries to record

Q33: Which of the following statements is correct?<br>A)Since

Q36: What would be the journal entry to

Q39: Indicate whether each of the following items

Q41: Assuming that Larmer is NOT a joint

Q44: The amount of current liabilities appearing on

Q60: How should the acquisition cost of a

Q68: Which of the following is the amount

Q115: Cosby Company is attempting to develop the