The following information pertains to questions

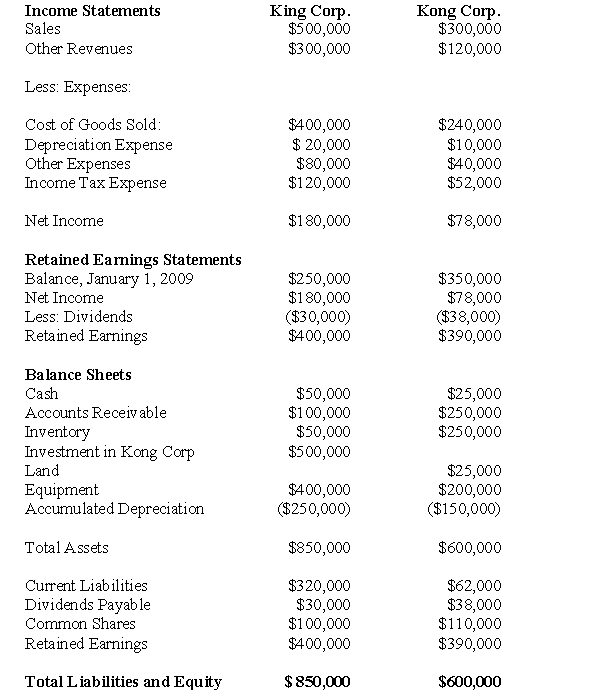

King Corp.owns 80% of Kong Corp and uses the cost method to account for its investment,which it acquired on January 1,2009.The Financial Statements of King Corp and Kong Corp for the Year ended December 31,2009 are shown below:  Other Information:

Other Information:

King sold a tract of Land to Kong at a profit of $10,000 during 2009.This land is still the property of Kong Corp.

On January 1,2009,Kong sold equipment to King at a price that was $20,000 higher than its book value.The equipment had a remaining useful life of 4 years from that date.

On January 1,2009 King's inventories contained items purchased from Kong for $10,000.This entire inventory was sold to outsiders during the year.Also during 2009,King sold Inventory to Kong for $50,000.Half this inventory is still in Kong's warehouse at year end.All sales are priced at a 25% mark-up above cost,regardless of whether the sales are internal or external.

Kong's Retained Earnings on the date of acquisition amounted to $250,000.There have been no changes to the company's common shares account.

Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a Fair value that was $20,000 higher than its book value.This inventory was sold to outsiders during 2009.

▫ A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000.The patent had an estimated useful life of 3 years.

▫ There was a goodwill impairment loss of $4,000 during 2009.

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization.

-What would be the amount appearing on the December 31,2009 Consolidated Statement of Financial Position for land?

Definitions:

Brand Manufacturer

A company that produces goods under its own name, as opposed to manufacturing products for other companies or brands.

Retail Pricing

The process of determining the selling price of products in retail stores, taking into account factors like cost of goods, market demand, and competition.

Trademark Status

The legal standing of a trademark, indicating its registration and protection status under trademark law.

Brand Names

The names given to products or services by companies to distinguish them from competitors' offerings and build brand identity.

Q10: Ignoring income taxes and any minority interest

Q10: What is the amount of the acquisition

Q12: Prepare Plax's Consolidated Income Statement for the

Q32: As an accountant, you are responsible for:<br>I.

Q39: Globecorp International has six operating segments,the details

Q50: What is the amount of the forward

Q50: According to IAS 29,the term "hyper- inflationary"

Q52: Which of the following rates would be

Q64: Strategic cost management focuses on all of

Q129: In a regression analysis for estimating a