inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

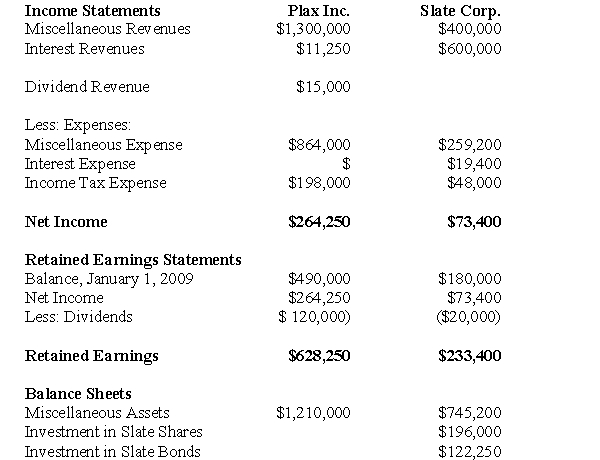

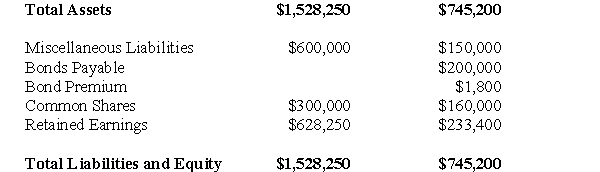

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare Plax's Consolidated Income Statement for the year ended December 31,2009.

Definitions:

Career Development

The ongoing process of managing one's work life, including choosing, advancing in, and possibly changing careers.

Characteristics

distinguishing features or qualities that define and identify a person, object, or phenomenon.

Factors

Elements or conditions that contribute to a result or outcome; variables influencing a process or event.

Multiple Roles

Describes the situation of individuals who simultaneously engage in various social positions or responsibilities, such as being a parent, employee, and spouse, and the complexities that arise from managing these roles.

Q12: What is the Consolidated Net Income for

Q16: Canada and the U.S both experimented with

Q17: Which of the following is NOT an

Q24: Assume that Stanton Inc's common shares had

Q25: Prepare a schedule of Realized and Unrealized

Q26: Section 4430 contains a compromise applicable to

Q38: Which of the following rates would be

Q45: Which of the following statements is correct?<br>A)If

Q46: Under which of the following scenarios would

Q60: Which of the following statements best describes