inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

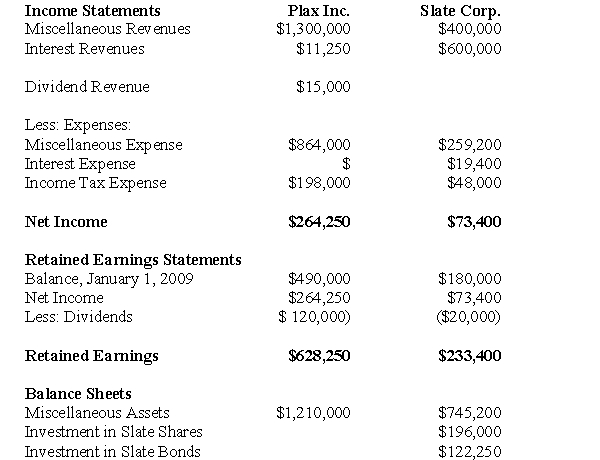

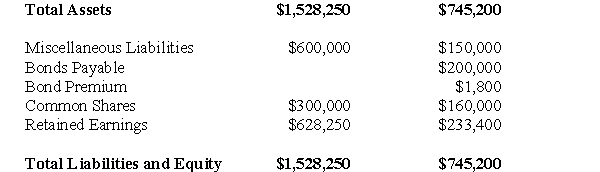

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Calculate the goodwill as at December 31,2009.

Definitions:

Ingroup Bias

The tendency to favor our own group.

Stereotyping

A cognitive process where individuals generalize attributes, characteristics, and behaviors to members of a particular group.

Prejudice

A preconceived opinion that is not based on reason or actual experience.

Hindsight Bias

The inclination to believe, after an event has occurred, that one would have predicted or expected the outcome.

Q2: Assuming that Keen Inc.purchases 100% of Lax

Q5: Collections are works of art that have

Q9: What is the amount of the hedge

Q9: Discuss the disclosure requirements for long term

Q18: Compute the amount of income tax that

Q24: The risk exposure resulting from the translation

Q35: In which fund would the purchase of

Q40: Company Inc.owns all of the outstanding voting

Q42: Dragon Corporation acquired a 7% interest in

Q84: Suppose the current average cost per km