inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

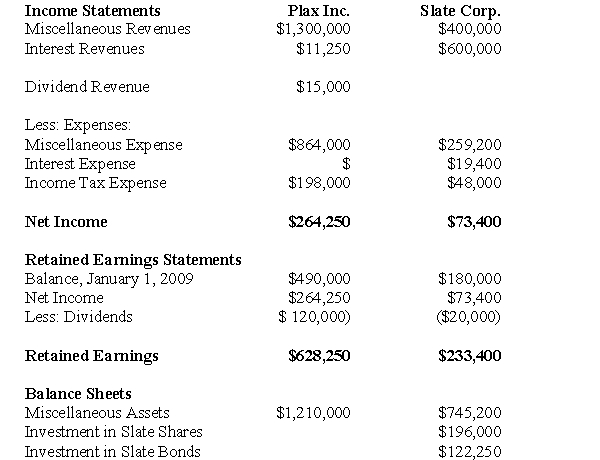

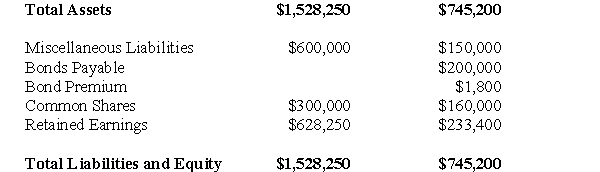

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a detailed calculation of consolidated retained earnings as at January 1,2009.Do not prepare a Statement of Retained Earnings for this requirement.

Definitions:

Causes

The reasons or factors that lead to an event or condition, explaining why something happens.

Consequences

The outcomes or effects that result from a particular action or condition.

Divorce

A formal termination of a marriage through judicial or authoritative intervention.

Stanford-Binet

A standardized test that measures intelligence and cognitive abilities in children and adults.

Q1: Irrelevant information may be:<br>I. Useful in decision

Q12: For each pair of sentences, select the

Q14: The topic sentence of paragraph 2 is<br>A)

Q21: Which of the following statements is correct

Q22: Which of the following accounting standards have

Q32: The amount of Retained Earnings appearing on

Q34: Which of the following is NOT a

Q41: What effect (if any)would Hanson's January 1,2010

Q74: Financial accounting information is often used as

Q113: Delta Hotels operates hotels throughout Canada. Which