The following information pertains to questions

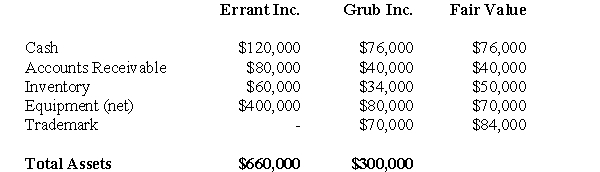

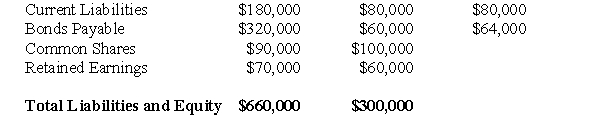

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-The amount of Retained Earnings appearing on the Consolidated Balance Sheet as at January 1,2007 would be:

Definitions:

Male-male Friendships

Social relationships between men characterized by companionship, emotional bonds, and mutual support.

Long-term Relationship

A romantic relationship between two individuals that lasts a significant period of time, often characterized by emotional attachment, commitment, and mutual support.

Romantic Partner

An individual with whom one shares a deep personal connection and romantic or intimate relationship.

Longitudinal Research

A research design that involves repeated observations of the same variables over short or long periods of time to identify changes or developments.

Q2: The European Union has attempted to harmonize

Q9: Which of the following statements is correct

Q9: Discuss the disclosure requirements for long term

Q15: The amount of non-controlling interest appearing on

Q16: The purpose of this paragraph is to<br>A)

Q18: Select the number of the topic sentence

Q24: What is the amount of RXN's foreign

Q27: Prepare a detailed calculation of Consolidated Net

Q33: Starting in 2011,what is the definition of

Q50: Approximately what percentage of the non-controlling interest