inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

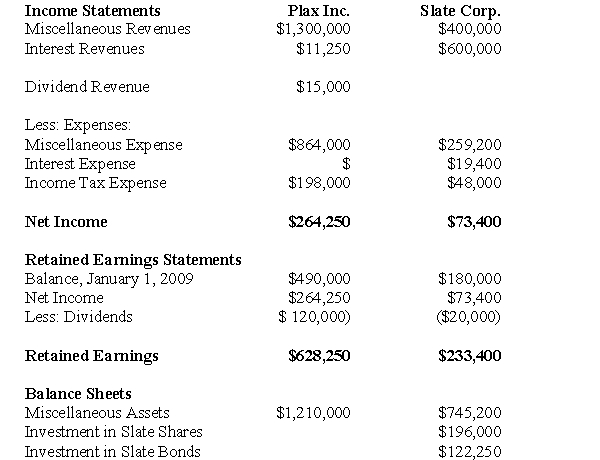

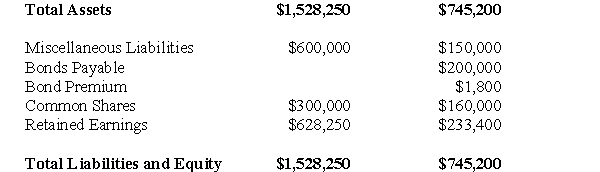

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a Statement of Non-Controlling Interest for the year ended December 31,2009 for Plax Inc.

Definitions:

Substitution Effect

The economic principle that as prices rise or incomes decrease, consumers replace more expensive items with less costly alternatives.

Dr. Pepper

A popular brand of carbonated soft drink, recognized for its unique blend of 23 flavors.

Utility-Maximizing

The economic principle where individuals or firms make choices that lead to the highest level of satisfaction or profit.

Satisfaction

The fulfillment or gratification of a need, desire, or appetite, often used in the context of consumer experiences with goods or services.

Q5: Prepare Lime's December 31,2011 Consolidated Balance Sheet.

Q13: For each pair of sentences, select the

Q15: What kind of order is used to

Q21: Which of the following statements is correct

Q21: Which of the following statements is correct?<br>A)If

Q33: _. When a fifteen-foot tiger shark bit

Q39: Minh is a cost analyst for TRN

Q41: Goodwill can best be described as:<br>A)The difference

Q50: Assuming once again that GNR owned 80%

Q52: Assuming that GNR Inc uses the Equity