The following information pertains to questions

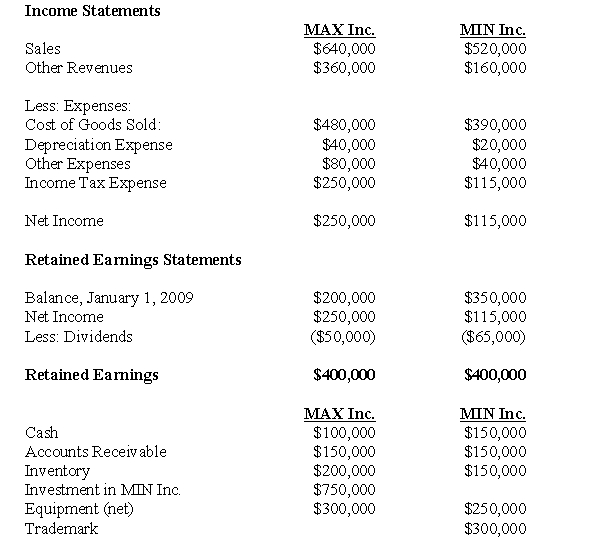

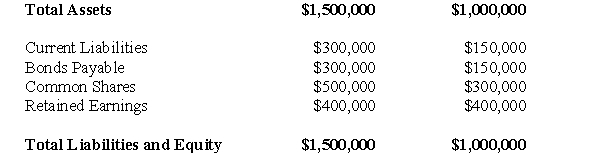

MAX Inc.purchased 80% of the voting shares of MIN Inc for $750,000 on January 1,2007.On that date,MAX's common stock and retained earnings were valued at $300,000 and $150,000 respectively.Unless otherwise stated,assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition.The bonds payable mature on January 1,2020.Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

A goodwill impairment test conducted during August of 2009 revealed that the Min's goodwill amount on the date of acquisition was overstated by $5,000.

During 2008,Max sold $60,000 worth of Inventory to Min,80% of which was sold to outsiders during the year.During 2009,Max sold inventory to Min for $80,000.75% of this inventory was resold by Min to outside parties.

During 2008,Min sold $40,000 worth of Inventory to Max,80% of which was sold to outsiders during the year.During 2009,Min sold inventory to Max for $50,000.80% of this inventory was resold by Max to outside parties.

All intercompany sales as well as sales to outsiders are priced 25% above cost.The effective tax rate for both companies is 50%.

-Compute MAX's Goodwill at the Date of Acquisition.

Definitions:

Savings

The portion of income not spent on current consumption or taxes, instead set aside for future use or investment.

Disposable Income

The money households have for spending and saving after subtracting income taxes.

Disposable Income

The amount of income left for spending or saving after taxes have been paid.

C + I

Represents the sum of consumer spending (C) and investment spending (I) in an economy's GDP formula.

Q1: The SEC made a monumental decision to

Q3: George Peterson is the President of Alpha

Q4: The focus of the Consolidated Financial Statements

Q8: Subject: the traditional places for the participants

Q16: Assume that Stanton's Equipment,Land and Trademark on

Q17: The amount of Goodwill arising from this

Q37: What would be the amount of the

Q38: Which of the following rates would be

Q40: Prepare the journal entries to record the

Q105: Relevant cash flows are:<br>A)Past cash flows<br>B)Future cash