The following information pertains to questions

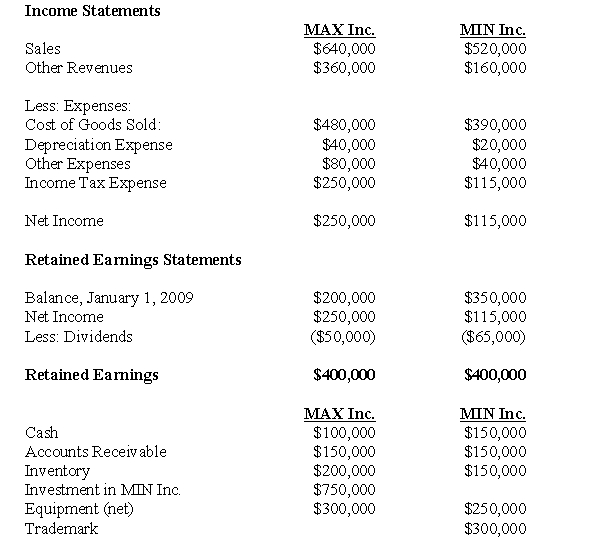

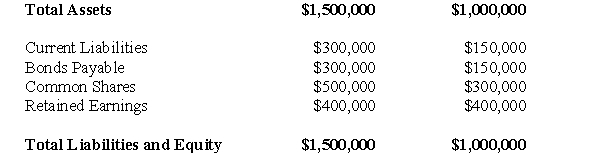

MAX Inc.purchased 80% of the voting shares of MIN Inc for $750,000 on January 1,2007.On that date,MAX's common stock and retained earnings were valued at $300,000 and $150,000 respectively.Unless otherwise stated,assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition.The bonds payable mature on January 1,2020.Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

A goodwill impairment test conducted during August of 2009 revealed that the Min's goodwill amount on the date of acquisition was overstated by $5,000.

During 2008,Max sold $60,000 worth of Inventory to Min,80% of which was sold to outsiders during the year.During 2009,Max sold inventory to Min for $80,000.75% of this inventory was resold by Min to outside parties.

During 2008,Min sold $40,000 worth of Inventory to Max,80% of which was sold to outsiders during the year.During 2009,Min sold inventory to Max for $50,000.80% of this inventory was resold by Max to outside parties.

All intercompany sales as well as sales to outsiders are priced 25% above cost.The effective tax rate for both companies is 50%.

-Prepare a schedule of Realized and Unrealized profits for 2009 for both companies.Show your figures before and after tax.

Definitions:

Superiors and Subordinates

The relationship dynamics between higher-ranking individuals and those of lower status or position within a hierarchical structure.

Bimodal Wealth Distribution

A type of wealth distribution in a society where the majority of resources are held by two distinct groups, creating a gap between a small, wealthy class and a larger, less affluent class.

Middle Class

A social group between the upper and working classes, typically characterized by moderate income, education, and professional jobs.

Highly Concentrated Wealth

A situation where a significant portion of wealth is held by a very small percentage of the population, leading to economic disparities.

Q1: Irrelevant information may be:<br>I. Useful in decision

Q4: Using only the Assets test,which of the

Q20: Assuming that Davis purchases 80% of Martin

Q25: Which of the following is NOT currently

Q29: Subject: the negative impact of TV violence

Q35: Cost accounting information is used for:<br>A)Financial reporting

Q39: Which of the following rates would be

Q55: Maude is considering opening her own business,

Q78: An error you make two, three, or

Q108: If a manager is deciding whether to