The following information pertains to questions

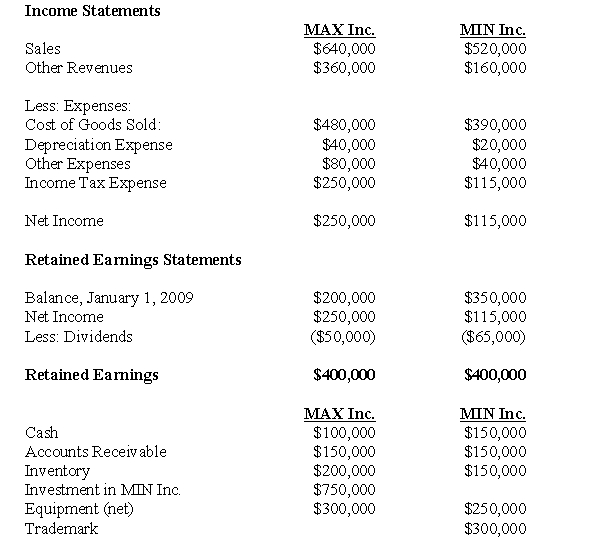

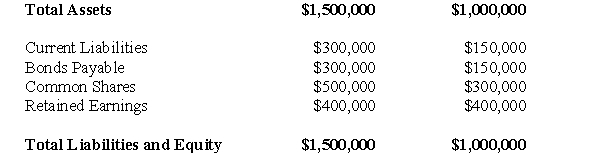

MAX Inc.purchased 80% of the voting shares of MIN Inc for $750,000 on January 1,2007.On that date,MAX's common stock and retained earnings were valued at $300,000 and $150,000 respectively.Unless otherwise stated,assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition.The bonds payable mature on January 1,2020.Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

A goodwill impairment test conducted during August of 2009 revealed that the Min's goodwill amount on the date of acquisition was overstated by $5,000.

During 2008,Max sold $60,000 worth of Inventory to Min,80% of which was sold to outsiders during the year.During 2009,Max sold inventory to Min for $80,000.75% of this inventory was resold by Min to outside parties.

During 2008,Min sold $40,000 worth of Inventory to Max,80% of which was sold to outsiders during the year.During 2009,Min sold inventory to Max for $50,000.80% of this inventory was resold by Max to outside parties.

All intercompany sales as well as sales to outsiders are priced 25% above cost.The effective tax rate for both companies is 50%.

-Calculate the non-controlling interest (Balance Sheet)as at December 31,2009.

Definitions:

Buffalo Bill

William Frederick Cody, known as Buffalo Bill, was an American soldier, bison hunter, and showman who founded Buffalo Bill's Wild West show.

American West

The region of the United States located west of the Mississippi River, historically significant for its development and expansion during the 19th century.

Nonfarm Activities

Economic activities that do not involve agriculture, farming, or animal husbandry, typically in sectors like manufacturing, services, and technology.

Q2: What is the topic sentence of the

Q8: Beta Corp.owns 80% of Gamma Corp.The Consolidated

Q10: What is the amount of the gain

Q19: Assuming that Keen Inc.purchases 100% of Lax

Q25: Prepare a schedule of Realized and Unrealized

Q27: Assuming that the assets were purchased from

Q28: What would be the amount appearing on

Q35: Assuming that X's Investment in Y qualifies

Q38: What would be the amount of the

Q70: In order for one company to establish