The following information pertains to questions

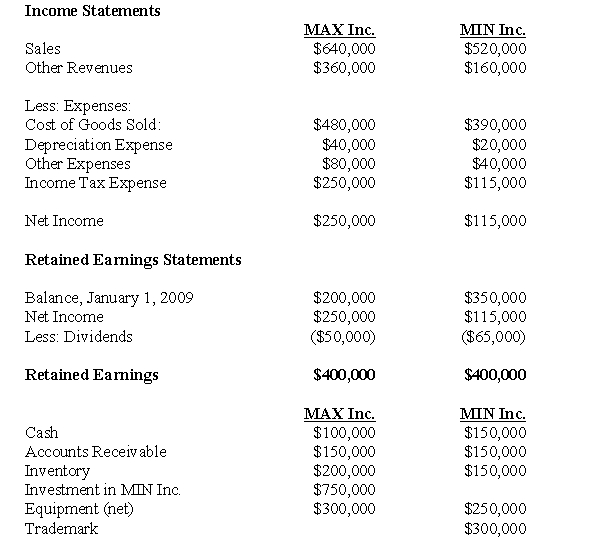

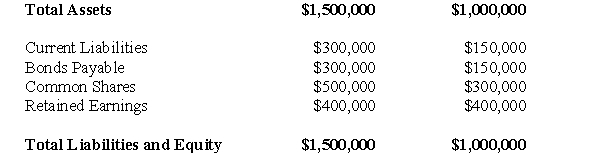

MAX Inc.purchased 80% of the voting shares of MIN Inc for $750,000 on January 1,2007.On that date,MAX's common stock and retained earnings were valued at $300,000 and $150,000 respectively.Unless otherwise stated,assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition.The bonds payable mature on January 1,2020.Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

A goodwill impairment test conducted during August of 2009 revealed that the Min's goodwill amount on the date of acquisition was overstated by $5,000.

During 2008,Max sold $60,000 worth of Inventory to Min,80% of which was sold to outsiders during the year.During 2009,Max sold inventory to Min for $80,000.75% of this inventory was resold by Min to outside parties.

During 2008,Min sold $40,000 worth of Inventory to Max,80% of which was sold to outsiders during the year.During 2009,Min sold inventory to Max for $50,000.80% of this inventory was resold by Max to outside parties.

All intercompany sales as well as sales to outsiders are priced 25% above cost.The effective tax rate for both companies is 50%.

-Calculate the non-controlling interest (Balance Sheet)as at December 31,2009.

Definitions:

Perfectly Elastic

Describes a situation in which the quantity demanded or supplied changes infinitely with even the smallest change in price.

Perfectly Inelastic

A situation where the demand or supply for a good does not change in response to changes in price.

Single Tax

A system where only one type of tax is levied, often proposed for simplifying the tax system.

Henry George

An American economist known for his advocacy of a single land tax and author of "Progress and Poverty," which argues land should be owned communally to address social inequalities.

Q6: What is the balance the Investment in

Q9: For the sake of simplicity,assume that US1's

Q19: _. Eggs are a great source of

Q19: Which of the following would not be

Q23: In which fund would the purchase and

Q31: Any goodwill on the subsidiary's company's books

Q31: Lori is deciding whether to go to

Q33: Starting in 2011,what is the definition of

Q39: Globecorp International has six operating segments,the details

Q41: Select the letter of the topic sentence