YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

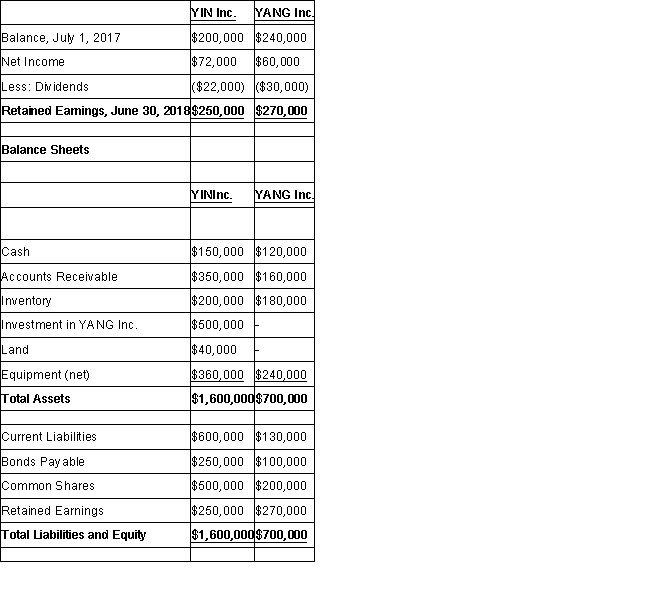

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Compute YIN's Goodwill at the date of acquisition.

Definitions:

Retail Life Cycle

The process of growth, maturity, and decline that retail businesses experience, similar to product life cycles.

Accelerated Development

The process of speeding up the creation and go-to-market strategy for a product or service to gain a competitive advantage or meet urgent demand.

Retail Life Cycle

The progression of a retail business or product through various stages, from introduction and growth to maturity and decline.

Discounting

The practice of reducing the price of goods or services, often to encourage quick sales or clear inventory.

Q2: On January 1,2004,Black Corporation purchased 15 per

Q5: Assuming that DEF456's Plant and Equipment was

Q6: If the functional currency of the foreign

Q11: What writing pattern does this paragraph employ?<br>A)

Q14: Prepare a schedule of realized and unrealized

Q26: You should wear sunscreen to protect your

Q27: What would be the carrying value of

Q32: Which decision has Canada made with respect

Q58: At what amount would CDN record its

Q95: Consider the following activities which could be