The following information pertains to questions

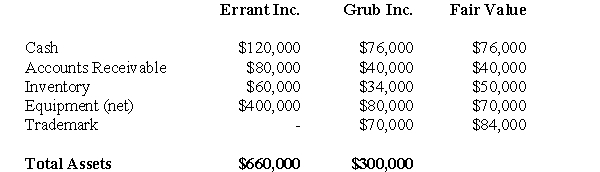

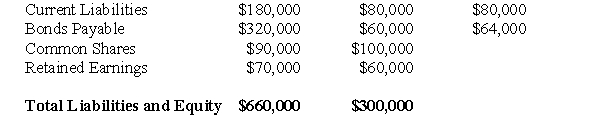

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

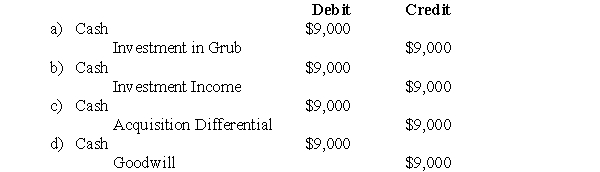

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-What would be the journal entry to record the dividends received by Errant during the year?

Definitions:

Annual Reports

Comprehensive reports issued by a company, detailing its activities, financial performance, and strategies over the previous year.

Information Interview

A meeting where a job seeker seeks advice on their career, the industry, and the corporate culture of a potential future workplace from an employed professional.

Application Letter

A written communication submitted to request or apply for a job, scholarship, or other opportunities.

Information Interview

A formal or informal conversation conducted to gather information about a job, career field, industry, or company from someone with firsthand knowledge.

Q6: This paragraph was written for an audience

Q9: XYZ Inc.owns 55% of DEF's 100,000 outstanding

Q25: One type of uncertainty managers face in

Q27: What is the required adjustment to ABC's

Q31: What amount would appear as Big Guy's

Q41: Higher quality decision making processes are less:<br>A)Biased<br>B)Certain<br>C)Creative<br>D)Focused

Q45: Assuming that Keen Inc.purchases 80% of Lax

Q46: Ronen Corporation owns 35% of the outstanding

Q57: Prepare a summary of intercompany interest revenues

Q96: Uncertainty may hinder a manager's ability to:<br>I.