The following information pertains to questions

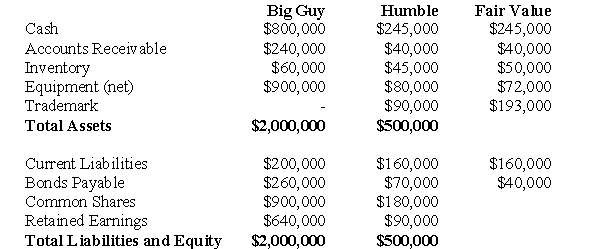

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

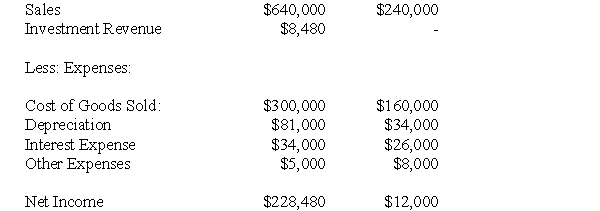

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

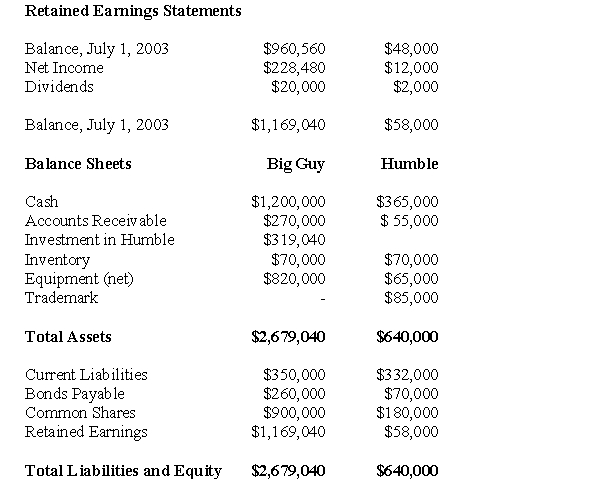

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-What amount would appear as Big Guy's investment in Humble Corp.on its July 1,2004

Consolidated Balance Sheet?

Definitions:

Unemployment Rate

The tally of unemployed workers in the labor force who are in the process of actively looking for jobs.

Economy

A system of production, distribution, and consumption of goods and services within a certain area or country, guided by laws, regulations, and cultural customs.

Employment

The condition of having paid work or the number of people currently hired to perform tasks in various sectors.

Point H

Similar to Point P, Point H likely refers to a specific position on a graph, chart, or mathematical diagram, indicating a particular data point or condition.

Q1: Which of the following is NOT a

Q2: Prepare a Balance Sheet for Clarke on

Q6: This paragraph was written for an audience

Q7: An internal report is:<br>A)Used for decision-making primarily

Q7: The net income generated by the net

Q10: Subject: _ <br>Audience: people who have adopted

Q11: The Net Income appearing on Big Guy's

Q38: Which of the following journal entries would

Q41: Select the letter of the topic sentence

Q50: What is the amount of the forward