The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

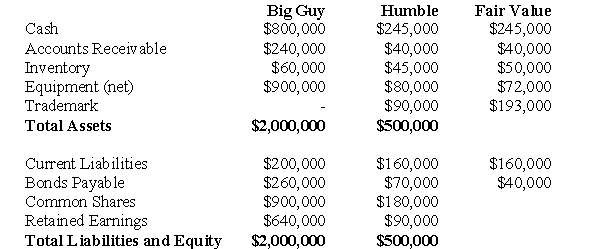

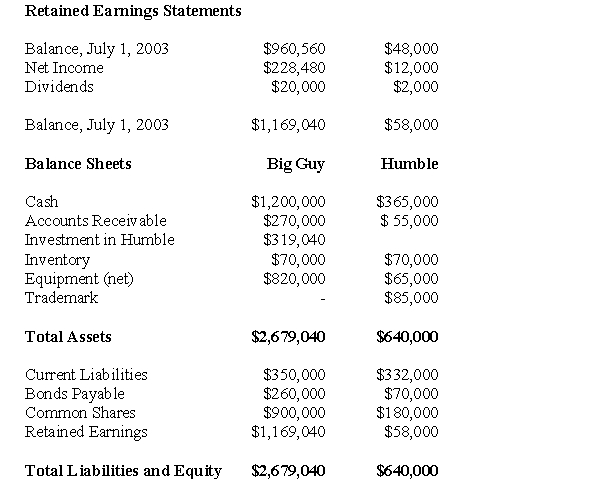

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

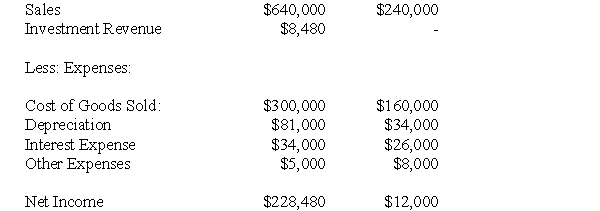

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of non-controlling interest appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Trade Credit

Short-term financing provided by suppliers, allowing buyers to purchase goods or services on account without immediate cash payment.

Compensating Balances

A requirement by some banks for companies to maintain a minimum balance in their account as part of a loan agreement, effectively reducing the amount of usable cash.

Management Policy

Guidelines and rules set by an organization's management to direct operations and decision-making in alignment with the company's objectives.

Credit Policy

A credit policy is a set of guidelines that a company follows to determine credit limits, payment terms, and how to manage delinquent accounts for its customers.

Q4: This paragraph will be about my family.<br>A)

Q19: What writing pattern does this paragraph employ?<br>A)

Q20: Many athletes use good luck charms in

Q27: Assume that Stanton had other Intangible assets

Q30: Since its inception Company X has had

Q31: Prepare Alcor's Consolidated Balance Sheet as at

Q37: What is the total amount of sales

Q40: Prepare Plax's Consolidated Statement of Financial Position

Q51: Which of the following statements is correct?<br>A)In

Q71: Which of the following methods of accounting